Market Timing: Do Not Try This At Home

Good morning all,

Lots going on, as always. We are all holding our breath (proverbially, at least) for the Budget on the 26th of November, the stock market continues apace upwards, and indeed, review season is upon us. That special time of year when we allocate time to really dive into how the past 12 months have been for clients of the firm, what it means for their money, and how we are positioned looking forward. I am extremely fortunate to now be working with 56 superb families.

Review season is a good place to start, actually. For the 15-20 client families that I normally meet in October or November, you will already have had your email invitation, and in many cases you have already booked your review. I’m looking forward to catching up with you all properly.

If you haven’t yet had an email, not to worry - you will be in the December or January round of reviews. Whilst clients and I meet throughout the year, I am a fan of having the formal detailed review well in advance of tax year-end. It just saves any last-minute rush as we approach the 5th April.

In “non-financy” (cue autocorrect screaming into the void) news, the family and I are heading to sunnier shores for a week from Tuesday 7th, which will be a really nice trip. I feel ready for a break, and I’m going to try – and likely fail – to properly “switch off” whilst away. That’s not a complaint, I love it. So, on that front, any book recommendations will be gratefully received.

In this month’s newsletter, we’ll be looking at a good example of market timing gone wrong, the usual pre-Budget rumours, and some visual wisdom.

Let’s dive in.

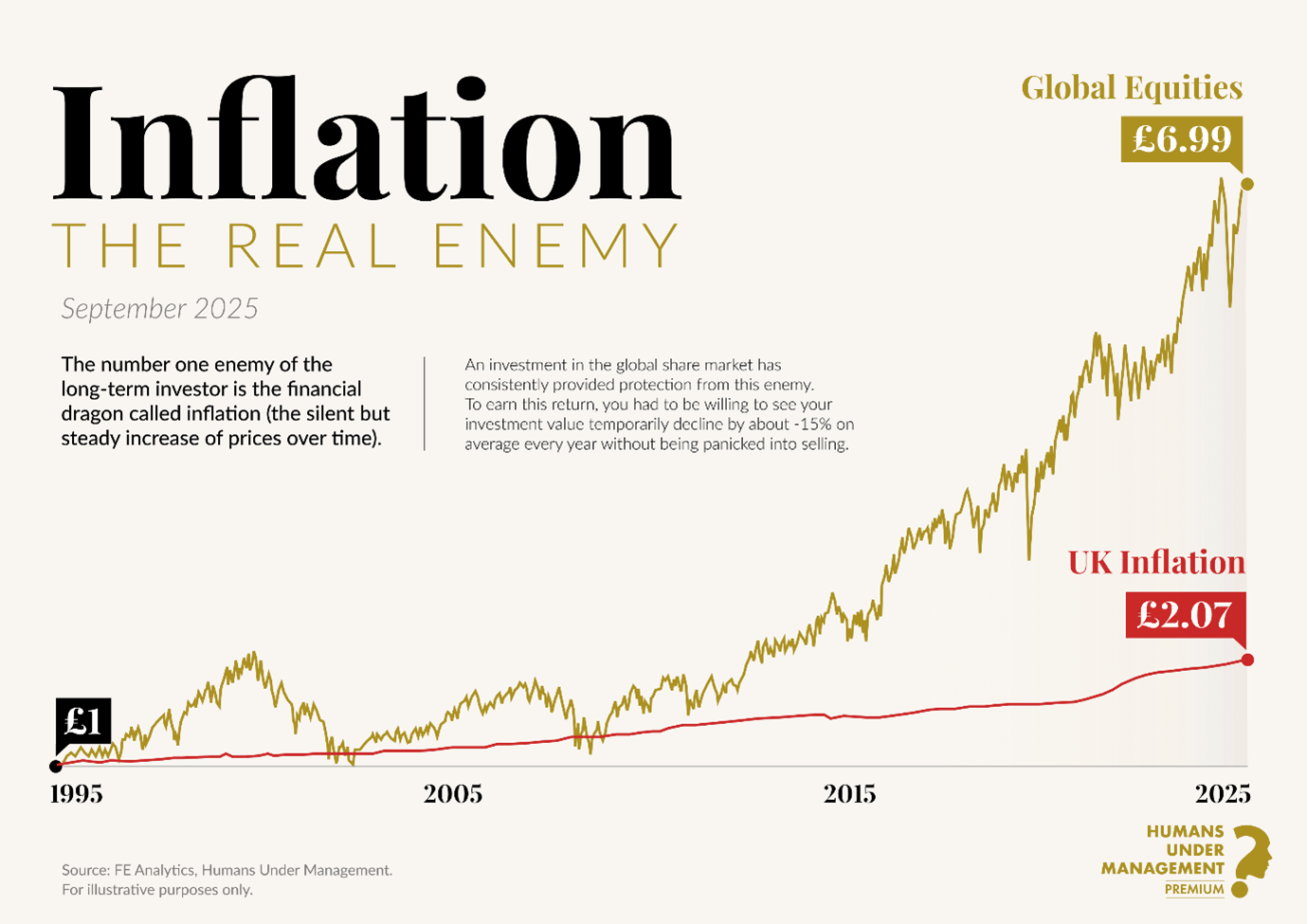

Monthly Market Visuals

Market Timing

‘Rich Dad, Poor Dad’ is one of the classic personal finance books, written by Robert Kiyosaki. It is estimated that Mr Kiyosaki sold over 40 million copies of this book. Very well done to him.

Briefly, the book is about the lessons learned from the author’s own father (“poor dad,” a well-educated but financially struggling man) and his best friend’s father (“rich dad,” a savvy entrepreneur). The book aims to challenge conventional views on money, arguing that financial education, investing, and building assets are much more important than simply having a big salary (which, if memory serves, leads to the second dad spending lavishly. It’s been a while since I read it).

Anyway, Mr Kiyosaki quite rightly will now have a handsome following in all the usual places. On the 4th of April 2025 – remember the tariffs? Fun times – he tweeted:

The S&P 500 was on 5,074.08 on the day of the tweet.

On the 1st of Oct 2025 it is 6,711.20 (source: Google Finance). If you took the above advice to heart and cashed everything in, you have potentially missed out on a 32.3% increase from low point to high point.

Ouch. Market timing is hard.

Is It Too Early To Put The Budget Decorations Up?

Only 55 sleeps to go (I’m writing this on the 2nd). Are you excited?

No, you are probably not. And nor am I, really. For one, it’s very delayed. That delay causes uncertainty, which can lead to panic, which in turn can lead to pretty disastrous outcomes in the wrong situation.

The usual rumours abound. So far, I’ve seen all of the usual favourites:

Loss of tax-free cash on pensions (hello, old friend)

Tax relief to be equated across the board

Dividend tax rates to match income tax rates

Principal private residence relief to be abolished.

The window tax to be re-introduced (this one is just to see if you’re paying attention. I probably shouldn’t give them ideas)

I’ll address the first one only, as this seems to be the one that would potentially affect most of the families that I work with. Now, never say never and the usual caveats apply in that I have absolutely no insider knowledge as to what the Chancellor will or will not do, but I consider the first one unlikely, and – “don’t say impossible, do not say impossible” – unmöglich to bring in overnight. This is for two reasons:

It would not be popular. The current Govt are trailing significantly in the polls and, according to most analysts, do not have much political capital left to spend.

It would be pretty grim to implement. Contracts would have to be re-written, there would likely be a legal challenge, and potentially further “protection” for those close to retirement age just now. That’s why I say that whilst it may happen, it won’t happen overnight. The lead-in time for pensions to come into the inheritance tax assessment was 2.5 years after the original announcement.

HMRC have also recently clarified that for those accessing tax-free cash in advance, the associated implications of that decision are irreversible.

So, that’s my tuppence worth. Take it as you will, but the advice from this end will always be to act on the facts as they are known, and not on speculation.

As always, if you have any questions or want to chat through your situation and how you are feeling, please do pick up the phone.

As a compliance insert, “impossible” is written in jest. It is of course possible that the Govt could change tax-free cash rules overnight, but I consider this extremely unlikely.

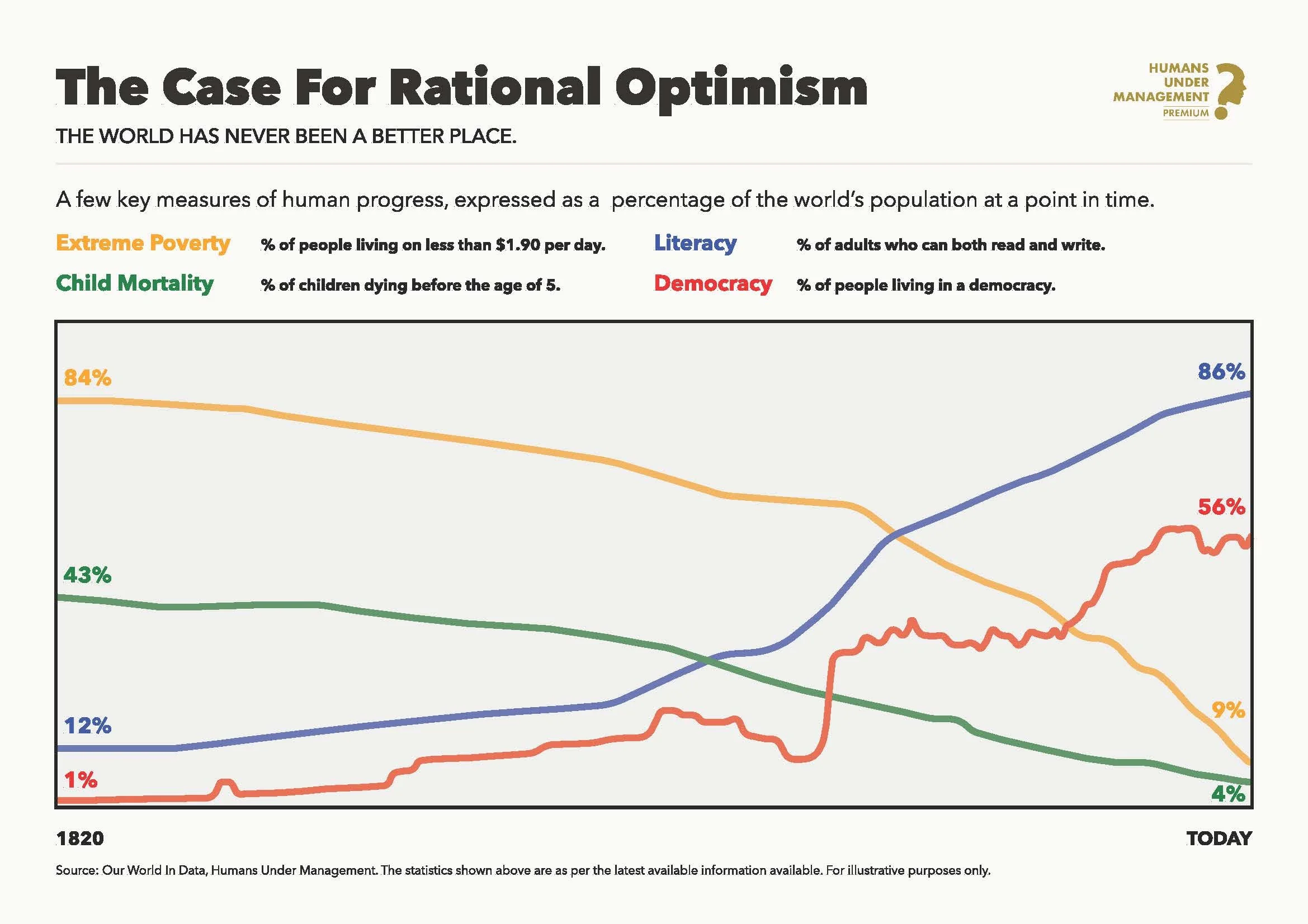

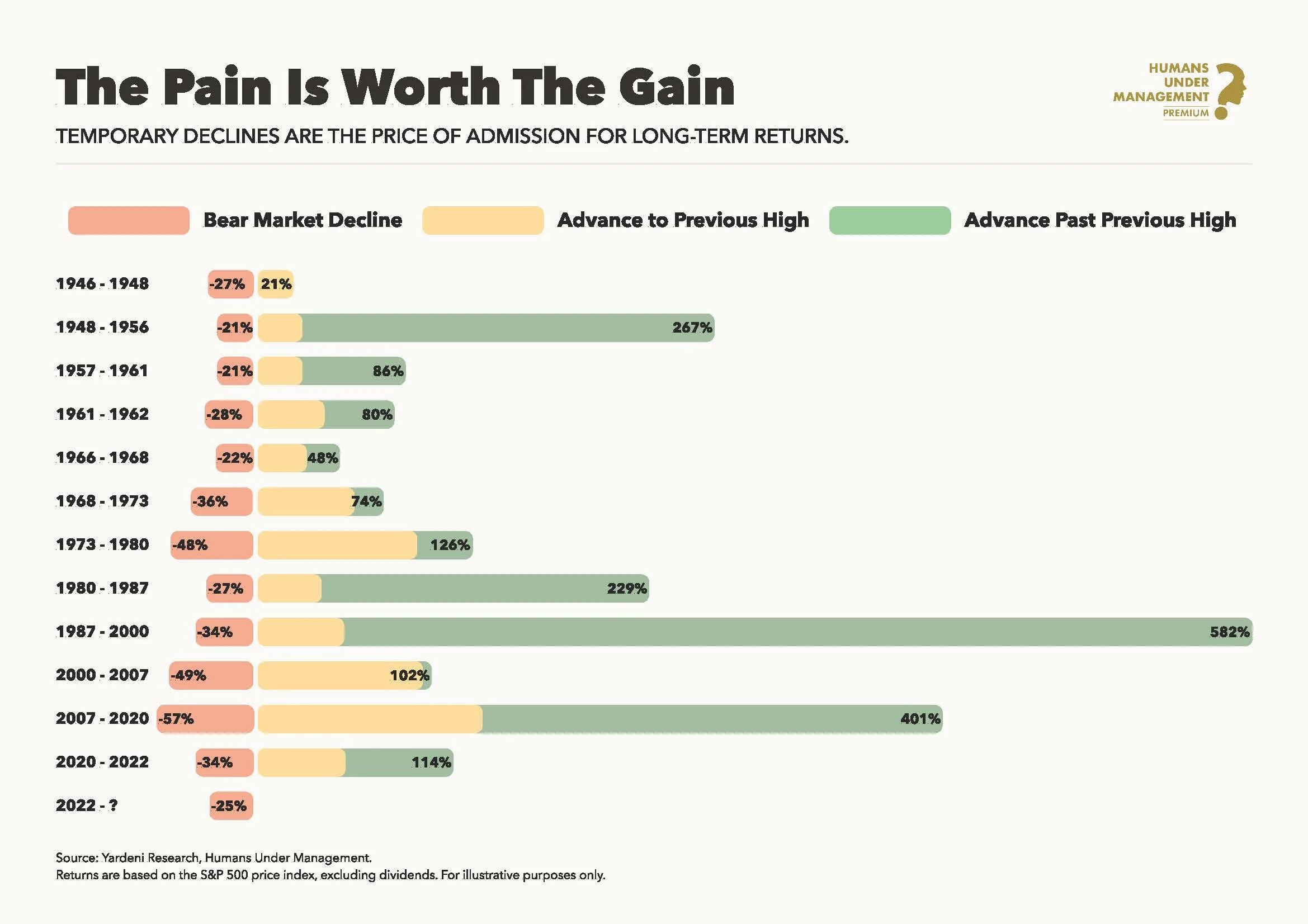

Wisdom in Picture Form

Because by and large, these images speak for themselves:

Optimism Prism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Austria and Italy Finish Digging World’s Longest Rail Tunnel

Apple Introduces AirPods Pro 3 with Live Translation Feature

Global Child Poverty Has Been on a Steady Decline Since 2014

Recommendations

This first one is focused at the parents/grandparents of young(ish) children amongst us, but if you’re in that category and you find yourself with the task of entertaining the little people for a full day, Almond Valley in Livingston is superb. It’s genuinely one of those places where you can spend the full day, and as a Brucey-bonus the little people will be knackered by the end of it.

And if you thought the first one was niche, this second recommendation is really going for it. For anyone who enjoys their home fitness the company Strongway is very worth a look. I have a small home gym, all supplied by them, and the quality and customer service is a breath of fresh air. 10/10.

And the last one is grounded purely in my own experience, nothing scientific here. If you’re feeling a bit overwhelmed and the constant negative noise is becoming too much, turn the phone off, leave the headphones, and get outside. Enjoy the crisp Autumn air. A dog isn’t essential, but they help.

That’s us for this month!

All the best,

Andy

The compliance bit:

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

Past performance is used as a guide only; it is no guarantee of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

The Financial Conduct Authority (FCA) does not regulate Inheritance Tax Planning or Trust Advice.

Levels and bases of, and reliefs from, taxation are subject to change and their value will depend upon personal circumstances. Taxation and pension legislation may change in the future.