Avoiding Life’s Roadbumps

Good morning all,

I really like November. Autumn is a beautiful time of year, isn’t it? If you can brave a quick glimpse through the hail and the blizzards, the odd amber leaf fallen from the towering oak above really does blend in well with the discarded Irn-Bru and Coca-Cola cans.

I’m joking, of course. No one in Scotland drinks Cola.

It is a smashing time of year though. My wee ones were confused and amazed in equal measure a few nights ago, as we were out walking the dog whilst the neighbourhood children were out guising (that might be the hill I die on, I’m resisting the Americanisms for as long as possible). They loved seeing everyone dressed up.

No, my kids weren’t in costumes and yes that’s bad parenting on my part, but their mum was working so the kids were already furious at being stuck with dad. I guess I could have said they were out guising as a pair of angry gnomes. Wouldn’t have been too much of a stretch.

Anyway, I shall at least try and stay on topic.

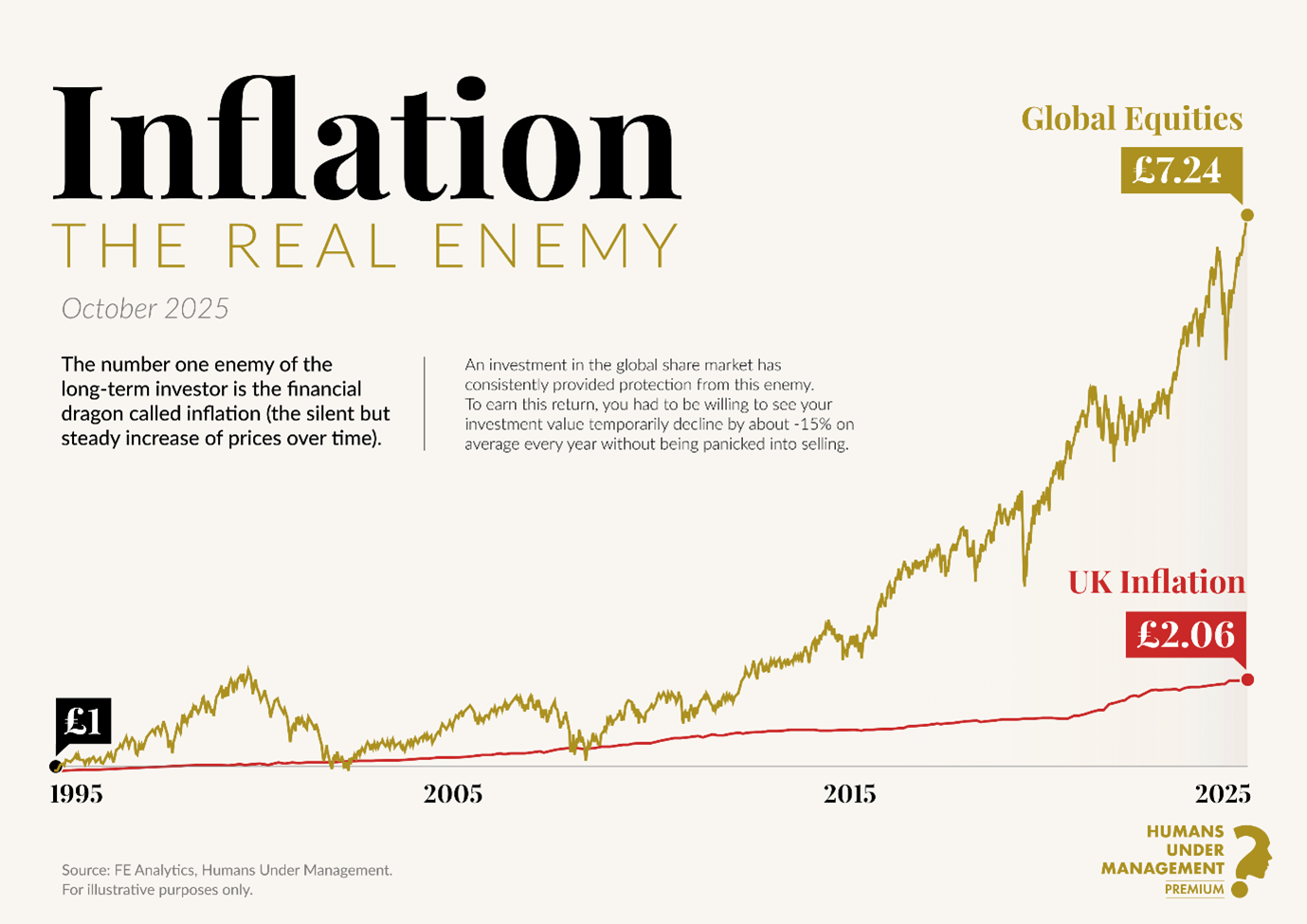

The stock markets continue their upwards climb. I won’t go into too much detail here, as I’m sure you are all aware of the ascent and the positive direction of your investments. What I would say however, sort of like a public service announcement, is that recent returns (in my view anyway) are well above what I would normally expect. Indeed, and no-one knows exactly when or how, but I would not at all be surprised to see some volatility before long.

So there, forewarned is foretold, and all that.

“But why wouldn’t you do something about it, if you thought the market was due a correction?”

“Ah, a good question my young padawan. Well, the answer is simply that just because we are due a correction/volatility (history being our guide), that does not mean that a) we will get one and b) that we will have any idea exactly when it will happen.

We should simply not be surprised if and when it does occur.

For volatility is the price of the above-average returns that stock market investors enjoy, and far more money has been lost (in the form of missed growth) waiting on the market to fall than has ever been saved by selling in anticipation of a fall.”

Monthly Market Visuals

Protect Yourself to Protect Your Wealth

Something perhaps a little different this time.

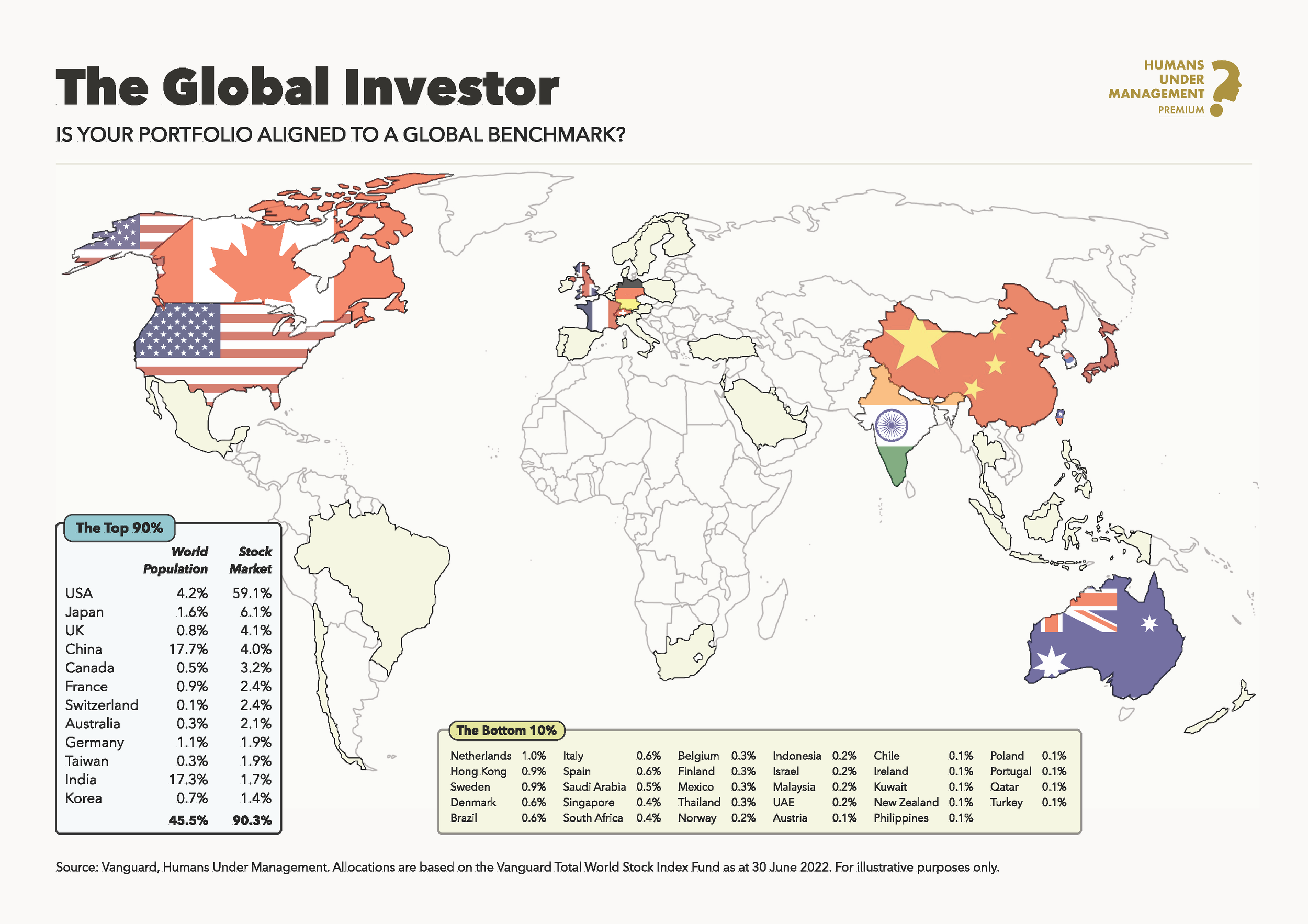

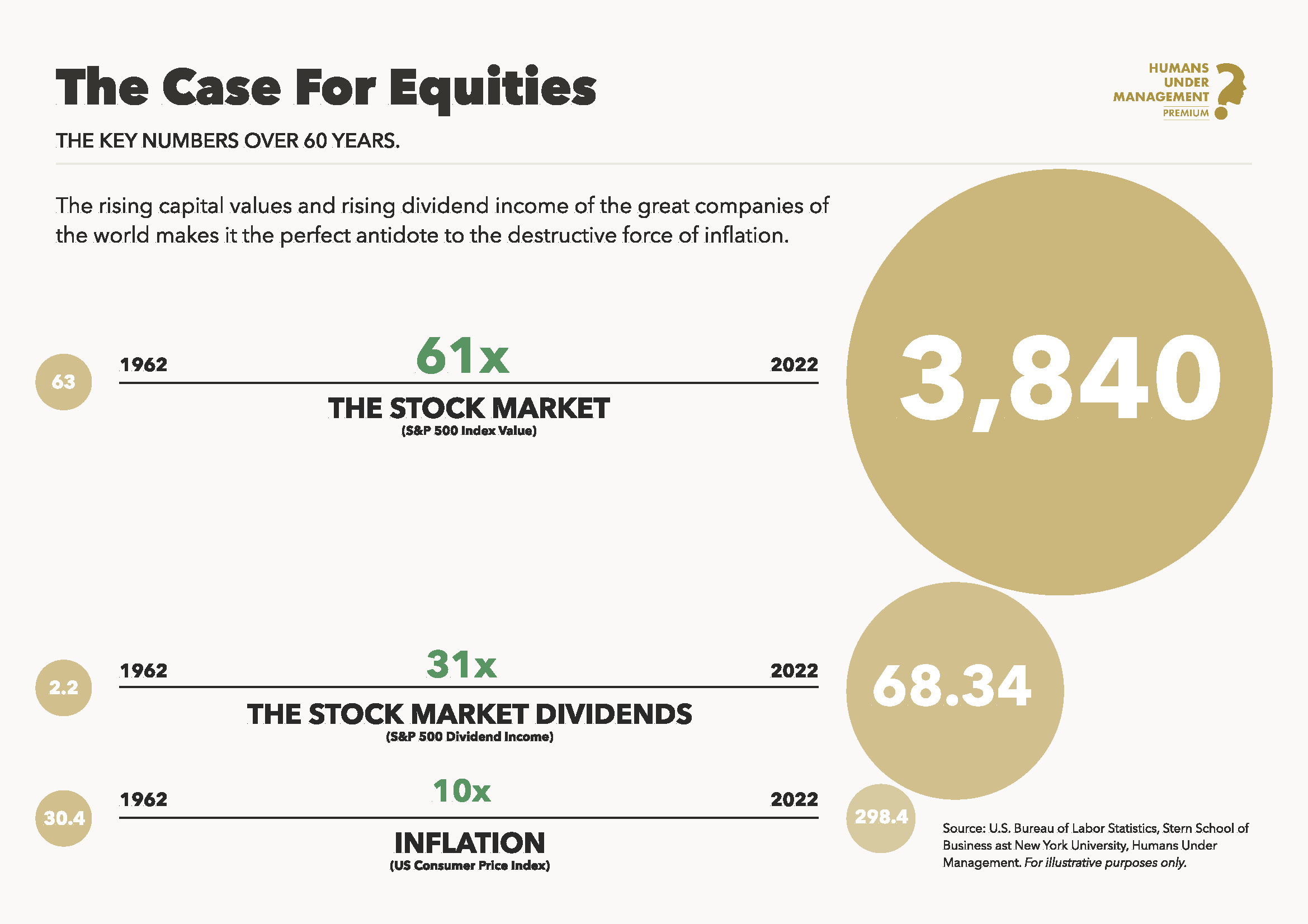

Often with this newsletter, and with most conversations with clients to be truthful, the bulk of the conversation focuses on growing one’s wealth. On the efficiencies that are available, on the importance of allocating capital correctly, on properly budgeting retirement spending.

But, just as important – and becoming more so perhaps with the April 2027 pension changes – is the vital role that insurance can play in our planning.

Insurance, or protection as it is often referred to in Financial-Planner-Land (protection sounds cooler, really, and is probably a better description of the purpose of insurance) is one of those things that we don’t really like thinking about. I certainly don’t anyway. And there is a myriad of different types of insurance; car, travel, pet, home, gadget, the list goes on and on.

And for most of the aforementioned categories, they are actually quite simple in practice. I’d wager that as a population we probably do quite well in those areas.

Flip the focus to insuring ourselves and our families, and the complexity increases, and in my view the overall coverage – the amount of us adequately insured, in other words – decreases.

For example, and this is just one option, but income protection is quite important. It has long been my view that if you are working and still a long way from retirement, you likely need income protection (assuming there is not a large cash pile parked somewhere to tide you over).

After a waiting period, an income protection policy would effectively replace one’s salary in the even that you are too ill to work. It’s not life insurance, but rather it is insurance for your ability to continually earn an income. Particularly important for those of us with dependents.

Private medical is another one worth considering if the budget will stretch to it. We all know the strains that the NHS is under at the moment.

So yes, lots of options. But I thought I’d mention this topic this time around, just to give us a little thought on the defensive nature of financial planning. It might not be as fun as talking about a 10% investment return, but it can be significantly more important.

Trusts. Make sure the relevant insurance is in trust. That conversation would be a whole couple of entries in its own right, so we’ll park it for now. The door is always open if you have questions.

The Third Act

Retirement, as a concept, has evolved significantly over the last 150 years.

When Otto von Bismarck established the world's first modern pension system in the 1880s, retirement was set at age 70 and life expectancy hovered around 45 years. This wasn't a golden chapter of life; it was merely a brief epilogue for the few who reached old age, often in declining health.

Fast-forward to today, and retirement has transformed dramatically. What was once a short period between work and death has evolved into a vibrant life chapter that might span 30+ years of active, healthy living. Yet many of us still follow outdated scripts for retirement, viewing it as life's closing scene rather than its third act (we recommend watching Jane Fonda’s 2011 TED Talk, “Life’s Third Act.”).

In theatre, the third act is often where character arcs develop fully and where the most powerful moments occur. Similarly, your retirement represents not an ending but a culmination, perhaps the most significant and fulfilling chapter of your life story.

From Career Identity to Life Director

Transitioning from Act Two (your working years) to Act Three often creates an identity challenge. After decades of being defined by professional roles, many new retirees find themselves asking, "Who am I now?"

We believe this moment of uncertainty presents an extraordinary opportunity. The retiree is stepping away from following someone else's script and into the director's chair of their own life production. This blank canvas provides creative freedom that previous generations could only dream of.

We have countless examples of clients who rediscovered, and built on, previous passions. Many of them describe themselves as more fulfilled than they ever were during their working years.

Are there passions or interests you set aside during your career that you might rekindle in retirement? The question becomes not "Who am I without my career?" but rather "Who do I want to become in this new freedom?"

The Four Pillars of Your Third Act

Just as any successful theatrical production requires a solid stage, lighting, script, and cast, directing a compelling Third Act requires establishing four essential elements in your life.

While financial security naturally remains essential (and likely has been your primary focus), research shows that a truly fulfilling retirement stands on four equally important pillars:

Financial Wellness: Resources to support your desired lifestyle without undue stress.

Physical Vitality: Health practices that maximise energy and capability.

Mental Engagement: Continued learning and cognitive challenges that keep you sharp.

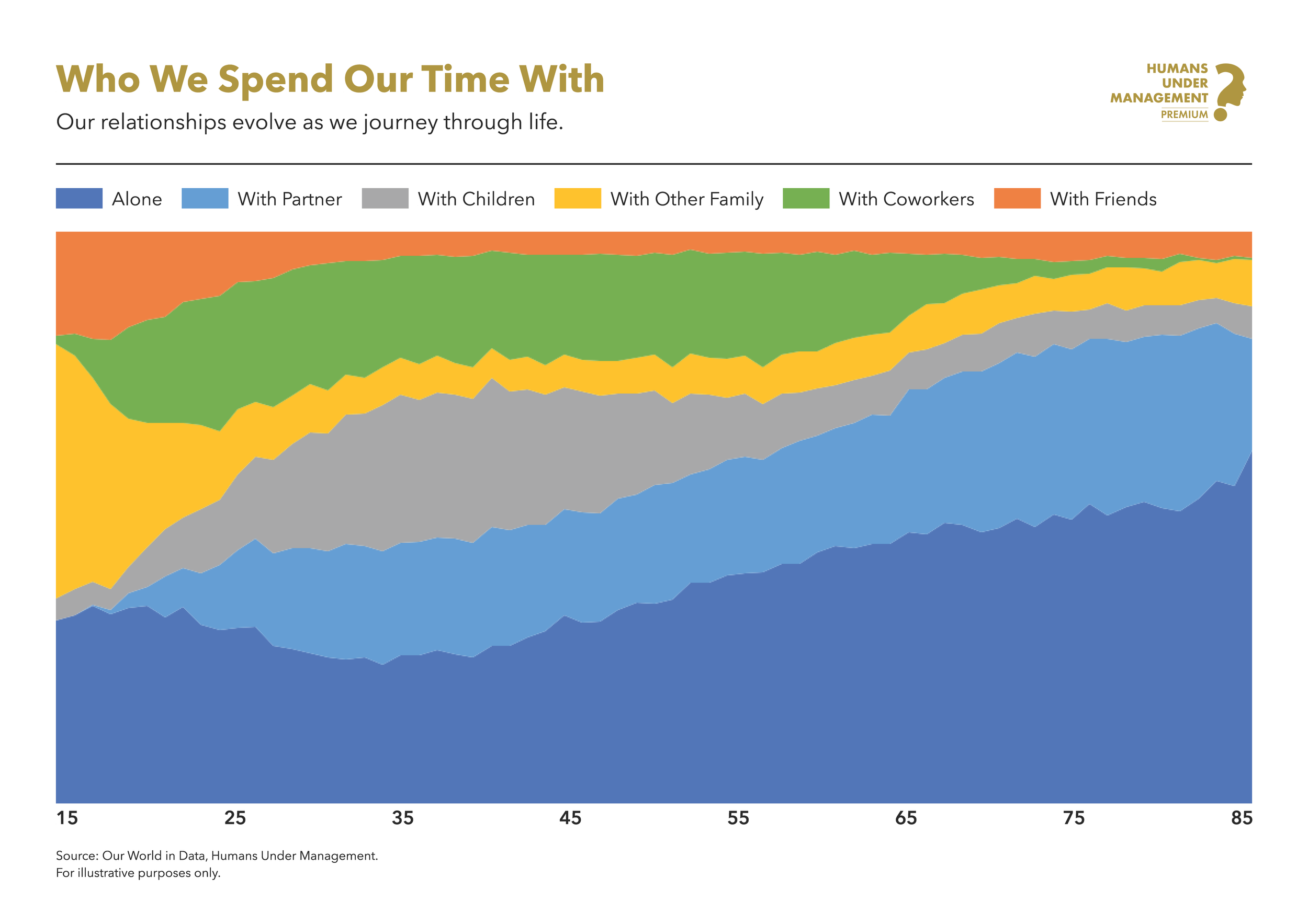

Social Connection: Meaningful relationships and community involvement.

When we focus exclusively on the financial pillar (as many traditional retirement plans do), we risk creating a well-funded but ultimately unfulfilling Third Act. The most satisfied retirees actively develop all four areas, recognising that wealth truly matters only when it supports a life rich in purpose, connection, and vitality.

Directing Your Daily Purpose

While these four pillars create the foundation for a fulfilling retirement, implementing them in daily life is the next challenge.

The paradox of retirement is that unlimited freedom can sometimes lead to diminished satisfaction. Without the structure that work provides, days can lose their shape and meaning.

We have found that successful retirees create purpose through three essential elements:

Plan: A flexible framework for how you'll use your time and resources

Purpose: Meaningful activities that provide direction and fulfilment

People: Relationships that offer connection, support, and joy

These elements transform retirement from an endless Saturday into a meaningful progression where each day contributes to your life's larger narrative.

As your financial advisers, we’re committed to helping you create financial security and a meaningful Third Act in which your wealth supports the life you truly want to live.

We invite you to begin thinking differently about your retirement today. Rather than asking, "Do I have enough?" we encourage you to ask, "What story do I want my Third Act to tell?"

Wisdom in Picture Form

Optimism Prism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

The Zipper Is Getting Its First Major Upgrade in 100 Years

Nobel Prize Win Buoys Business Case for Creating Water from Air

Austria and Italy Finish Digging World’s Longest Rail Tunnel

Recommendations

The memories section on our phones. You know, when the phone pings you a notification saying “this is where you were 3 years ago”, or some-such. I absolutely love that; it’s my favourite feature about my phone. If you don’t have that setting turned on (but I’m sure you will, as Google keeps trying to sell my pictures of my pictures, so I’m sure you’re in the same boat) it is well worth doing.

‘Die With Zero: Getting All You Can from Your Money and Your Life’ – Because there is no point in being the richest person in the graveyard. Another phrase I like is, gift with a warm hand rather than a cold one.

That’s us for this month!

All the best,

Andy

The compliance insert:

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

Past performance is used as a guide only; it is no guarantee of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

The Financial Conduct Authority (FCA) does not regulate Inheritance Tax Planning or Trust Advice.

Levels and bases of, and reliefs from, taxation are subject to change and their value will depend upon personal circumstances. Taxation and pension legislation may change in the future.