A Word Salad, Visual Wisdom, and the Budget

Good morning all,

You have the dregs of an introduction today, ladies and gentlemen. I am typing this section of the newsletter at 4pm (the first time I keyed the time there I got it wrong, a precursor for what’s to come) on the afternoon of Friday 29th August, when 75% of my grey matter has already checked itself out for the week. It is doing a happy dance in anticipation of a relaxing weekend.

Regular readers, and indeed anyone who knows me, will know that is of course an outright lie. There are no relaxing weekends with toddlers in the house. None. They are a thing of the past, a mirage of a forgotten peaceful utopia. Indeed, this weekend the toddler god is being especially vengeful, as he has bestowed upon us an additional set of 1 year old twins and a 4-year boy, bring the total up to five children. Glory be.

The party-political version of the above is that our friends have come to visit for the weekend. And we’ll leave it there.

I digress, and lacking a proper segue (that’s “segway” for the uncultured masses – yours truly included. I have just realised I actually did write “segway” in last month’s entry #facepalm. Could edit, probably should edit… Ah, let’s leave it) we’ll just dive full on into the personal finance world.

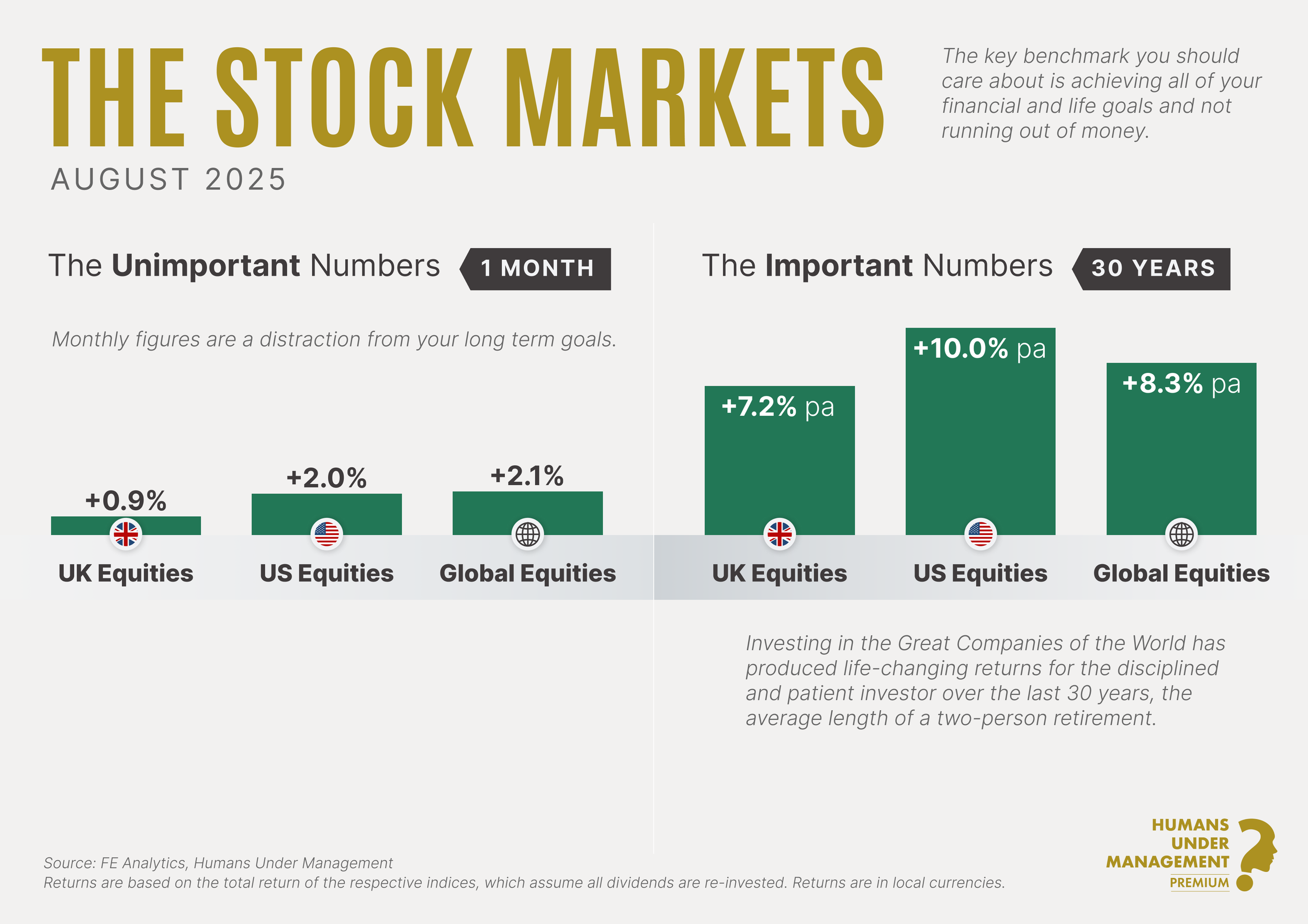

Monthly Market Visuals

A Word Salad

Have you read Shakespeare?

Being an uncouth degenerate, I admit I have not. I haven’t even had the pleasure of seeing one of his plays, although I am broadly familiar with some of the stories.

The good guys have the blue lightsabres, yes?

The Harry Potter books however, are a different kettle of fish. Those books I have read many times over and shall do again. It wouldn’t be my specialist subject on Mastermind – that would be Still Game for those wondering, or I guess lately, Paw Patrol – but many moons ago it might have come close.

Where on Earth are you going with this Reynolds? All in good time, young Padawan.

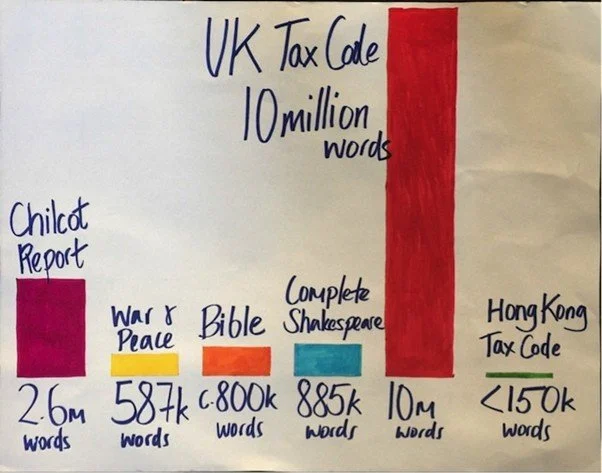

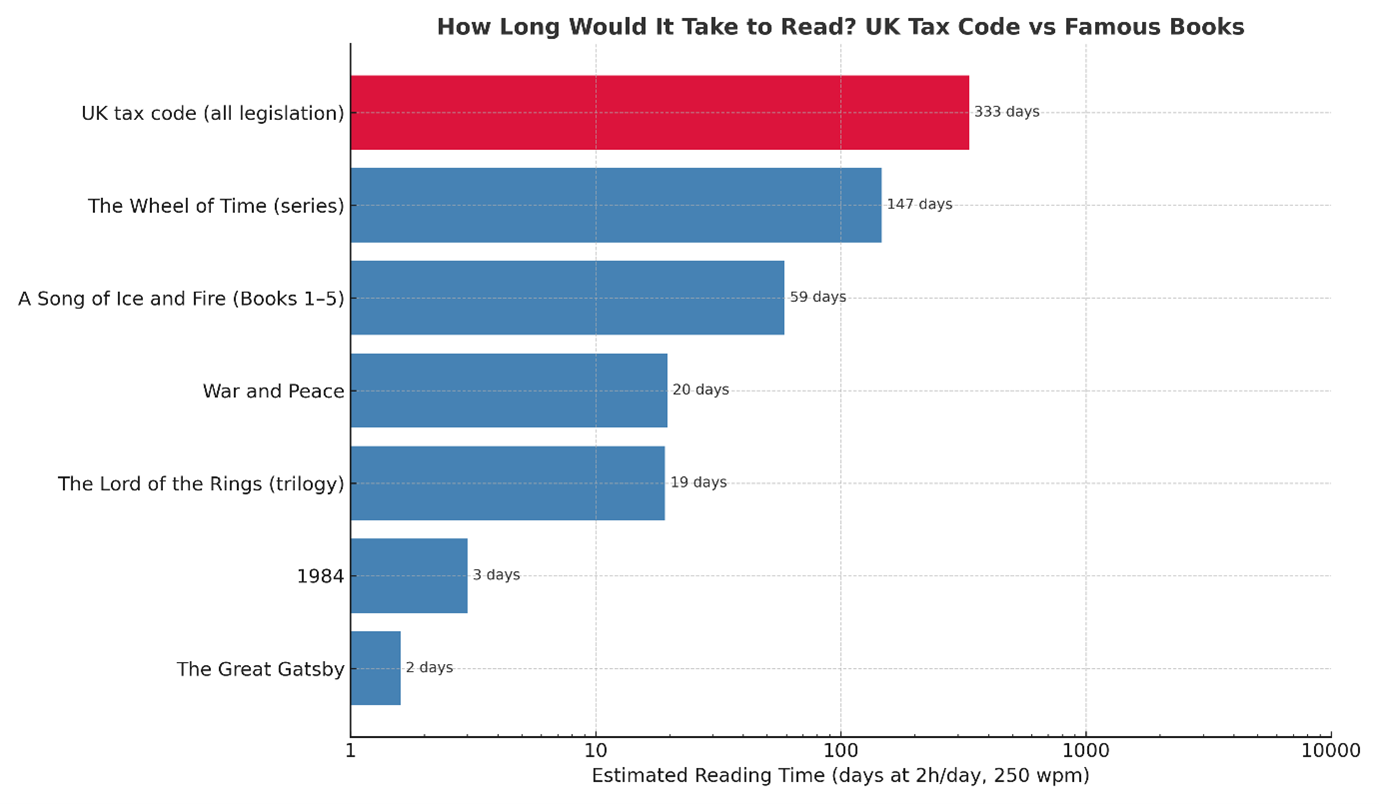

The wonderful Harry Potter book series is some 1.1 million words. The Bible, by comparison, is around 800,000. Lord of the Rings (also outstanding) total up at approx. 576,000 and the gargantuan Game of Thrones series (books 1-5) knocks up an impressive 1.8 million words.

The UK tax code – a mere 10 million words.

It is longer than every classic of English literature combined. Reading 8 hours a day, no breaks, no holidays and weekends also spent digesting CGT and corporation tax rules, it would only take a brief 11 solid months to get through the full thing.

And what wisdom does this treasure trove bestow upon us? Are we blessed with the Mecca of tax codes, a shining example of clarity? Erm, no, we are not.

I present to the court:

Cakes are zero-rated for VAT, biscuits are not (unless the biscuit is chocolate-covered, in which case it’s standard-rated at 20%). See the famous Jaffa Cake case, where apparently McVitie’s baked a massive Jaffa Cake and brought it into the court to demonstrate it’s “cake-like” qualities.

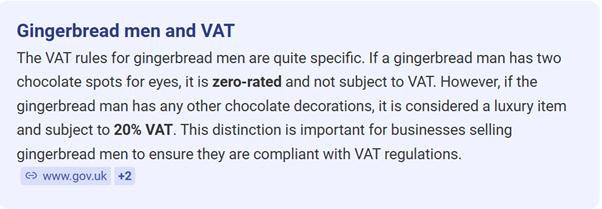

Sticking with the food theme, this time it’s Gingerbread men: No VAT is charged if the figure has two chocolate spots for its eyes, but any chocolate-based additions, such as buttons or a belt, mean VAT is payable. I don’t really know where to go with that one.

Fruit juice = zero-rated for VAT. Smoothies, however, are standard rated because they are treated as a “luxury drink.” So, blending the exact same fruit you could have sold as juice moves it from 0% VAT to 20%.

The UK used to have a Window Tax (1696–1851). Houses were taxed on the number of windows they had. Result - landlords bricked up windows to avoid the tax, leading to poorer health.

Apparently, we were also once the purveyors of a Wallpaper Tax (1712–1836). Plain wallpaper was tax-free, whereas printed wallpaper incurred a tax per square yard. People got around it by buying plain paper and stencilling patterns at home.

Madness. It may appear to the untrained eye that by removing some of the proper oddities above from our tax system, it has gotten better. Perhaps so, but we are still left with some absolute corkers in terms of “cliff-edge” consequences:

The loss of the personal allowance on income above £100,000.

The loss of child benefit above £60k, disappearing at £80k.

The loss of tax-free childcare above £100k – that one is a proper cliff edge, and the benefit is around £2,000 a year per child. A parent at £99,999 of income keeps it, a parent on £100,001 loses the whole whack (imagine the marginal rate of tax on that £2?!)

In England and Wales, the above could also mean a loss of the 15 hours of funded childcare as well, worth approximately. £6k per annum. Brutal, draconian stuff that would make even Genghis Khan blush. And who says the UK doesn’t support working parents?

Inheritance tax planning – estates over the value of £2m start to lose some of their residential nil rate band. This increases the marginal tax rate on assets immediately above £2m to more than the standard 40% inheritance tax rate that we all know and love.

What’s my point here? Well, several I guess, but in the event that any aspiring politicians are reading this (they aren’t) my vote is very much up for grabs to whomever sorts out the above.

Simplicity, please and thank you.

Otherwise, aside from the fact that HMRC might secretly be running a comedy writers’ room, it shows that our tax system is not designed with simplicity, fairness, or even common sense in mind. It’s a ramshackle volume of old rules, new rules, political quick fixes and cake-based exceptions that together create a landscape where one step in the wrong direction can suddenly cost you thousands.

Here comes the segue! Are you excited?

Thankfully, it’s my job to understand this, not yours. Or, in better language, to translate it into something that actually works for you and your family. To make sure that when you’re standing on £99,999 of income, or your estate nudges £2m, or you’re considering how best to fund your retirement, that we plan as best as we can and avoid any big mistakes.

You just need to know that someone is paying attention, so you can focus on the things that really matter; your family, your future, and, presuming you are anything like me, re-reading Harry Potter for the umpteenth time.

PS: On the above, I actually had to be the bearer of bad news recently, explaining to a father that he had lost his entitlement to tax-free childcare. This was as a result of the new job that he was super excited about, and instead he could expect a subsequent tax bill. That didn’t feel nice.

PPS: For another example of the complexity of our tax system, we have only to listen to the headlines and read the front pages today regarding the troubles of Deputy PM Angela Rayner.

Wisdom in Picture Form

UK Budget & Client Reviews

I am not thrilled with the delay to the Autumn Budget, now confirmed as Wednesday 26th November.

I just hope that we will avoid the weeks / months of speculation regarding the usual stories (pension tax-free cash being removed, pension tax relief being removed, etc), but that is perhaps a forlorn hope.

I won’t spend a lot of time on this, other than to say that any overnight change to pension rules - such as the way CGT was increased last year, on the day of the Budget - are extremely unlikely.

Many traditional pension providers rely on technology and back-office systems designed by the occupants of Noah’s Ark, and not much improved since then. The chances of them being able to instantly change their systems - not to mention the re-writing of contracts and applications in progress issue - is vanishingly small.

Annual Planning Meetings

As most of you will be aware, the firm intentionally runs its annual planning meetings from the months of November to February. The rationale here is that we have lots of time before the end of the tax year to make any changes, and we can consider the content of the latest Budget.

Invitations will be going out both this month and next - I am looking forward to catching up with you all properly.

Optimism Prism

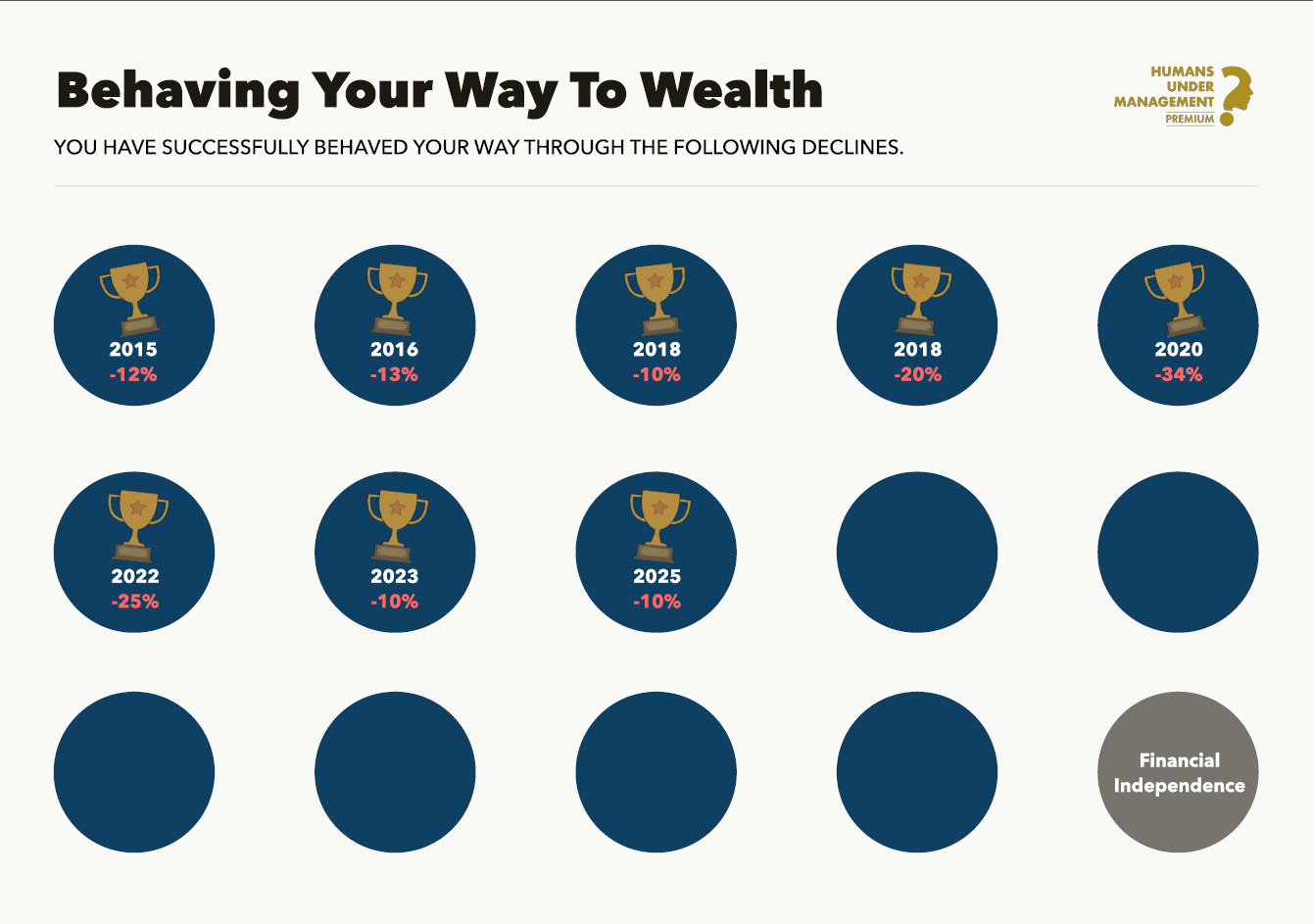

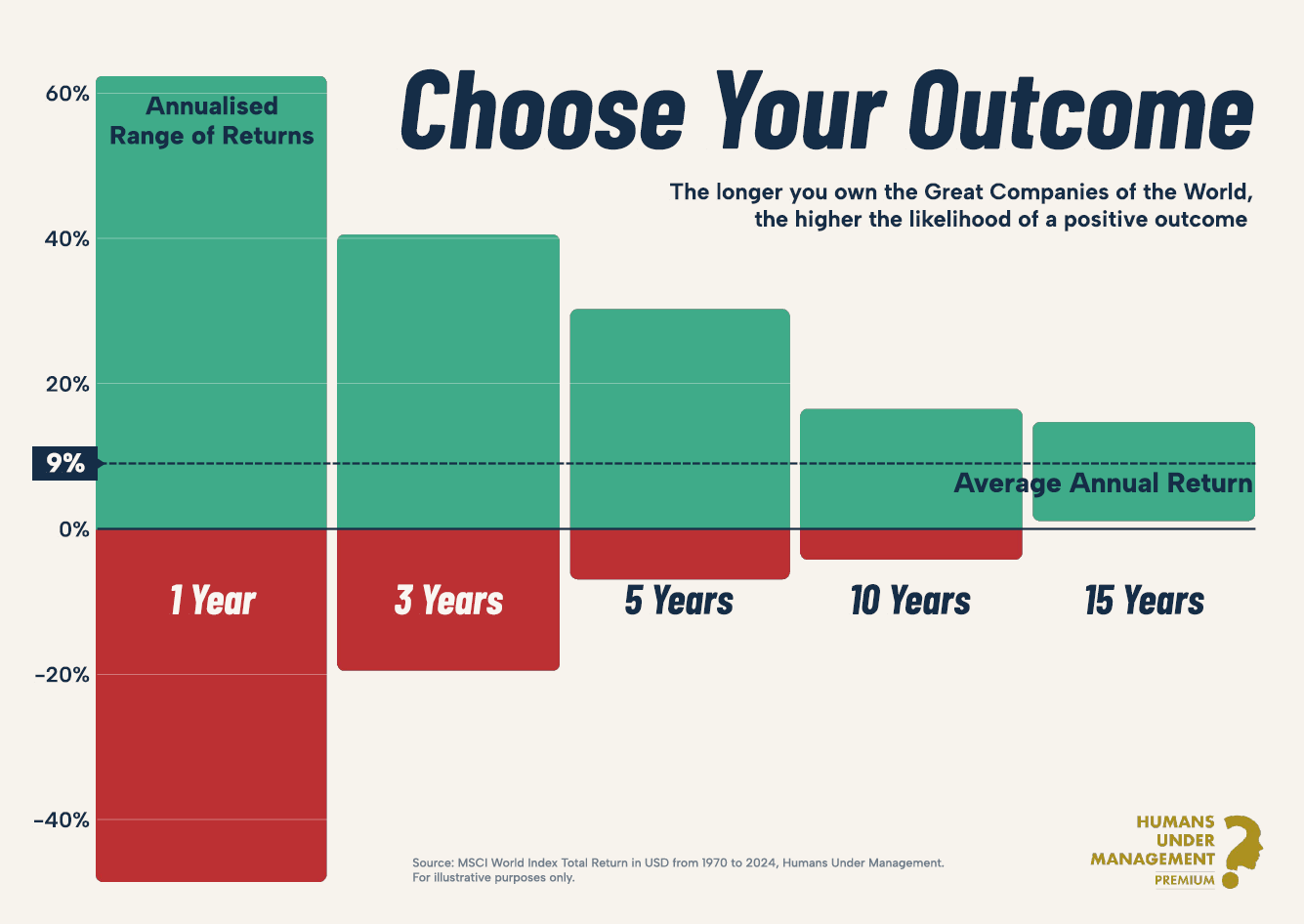

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Adaptation to Heatwaves in Europe Outpaces Climate Change

Recommendations

This is probably a bad idea, for me to start recommending music, but we can add it to the long list of errors in this newsletter. I have a very wide-ranging Spotify history, from acoustic covers (and even classical on occasion if I’m working) to Slipknot, Papa Roach, and anything loud and noisy if I’m in the gym.

Anyway, Ed Sheeran’s “Old Phone”. Outstanding, and with a cool backstory. The v.short version is that he was being sued for plagiarism and he had to turn on his old phone he switched off years ago as part of the court case (he doesn’t use a phone normally). He won the case, I understand.

Abi and I managed to see him in Marseille when we were in France a few months ago. Superb gig, and a true performer in every sense of the word.

The Psychology of Money – Morgan Housel. 19 short stories, very digestible, relatable, and thought-provoking. A great gift if you’re looking for something different. Think of this as the modern equivalent of The Richest Man in Babylon (also another cracker); timeless money lessons but written for today’s world.

I was gifted this bottle of wine by an absolute gentleman, Elliot Smith of Wealth Spring in London. It was probably the best white wine I have ever tasted - have a go and let me know what you think.

That’s us for this month!

All the best,

Andy

The compliance bit:

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

Past performance is used as a guide only; it is no guarantee of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

The Financial Conduct Authority (FCA) does not regulate Inheritance Tax Planning or Trust Advice.

Levels and bases of, and reliefs from, taxation are subject to change and their value will depend upon personal circumstances. Taxation and pension legislation may change in the future.