Sir Steve Clark, The Budget, and Looking Backwards

Good morning all,

And so, we now – mostly - know the lay of the land. After months and months of speculation, thousands of opinions on what approach to take, we have the final result, and we can begin to plan accordingly.

Yes, Scotland 4 – 2 Denmark, and we’re off to the world cup! Get that statue of Sir Stevie Clark commissioned ASAP.

I couldn’t not start with that, before getting our teeth stuck into the personal finance landscape. I have been to many – thousands? Surely not, there’s a thought – of football games in my life, but that game a few weeks ago really was something else. Superlatives abound, and it’s impossible not to use cliches for such a game as that, so I will simply defer to this superb commentary from the BBC Scotland team. The stuff of legend. Oh and this too, from 15 seconds in.

We now return to your regularly scheduled programming.

Monthly Market Visuals

My Take on the Budget

Before we get into the meat and potatoes of this budget, I will try to sum it up in one word – complexity.

Firstly, I am grateful that the speculation can go on the back burner for a few months, at least. I think every possible tax rise was trialled in the months leading up to the budget and, in the end, there was nothing that was too revolutionary (although, lots of devil-in-the-detail emerging already).

It would be foolish not to note that this was very much a tax-raising budget. The increased number of higher rate taxpayers – moving to 1 in 4 by 2031 – is no small beans, and that is before we consider the additional punitive measures of the 2% saving, dividend and property tax.

Limited company owners who pay themselves via dividends – joiners, electricians, accountants, the list goes on – apparently do not meet the definition of “working people” in the Govt’s eyes.

There is lots to consider. I won’t go through all of the changes – we would be here all day – and will instead focus on three of the main ones, and my initial thoughts.

Cash ISA reduction – Dropping to £12k for those under the age of 65.

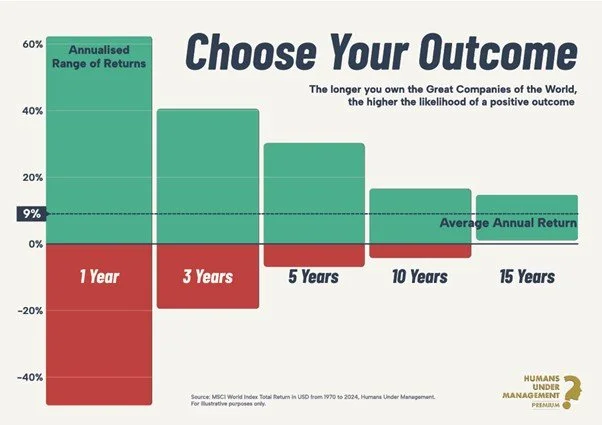

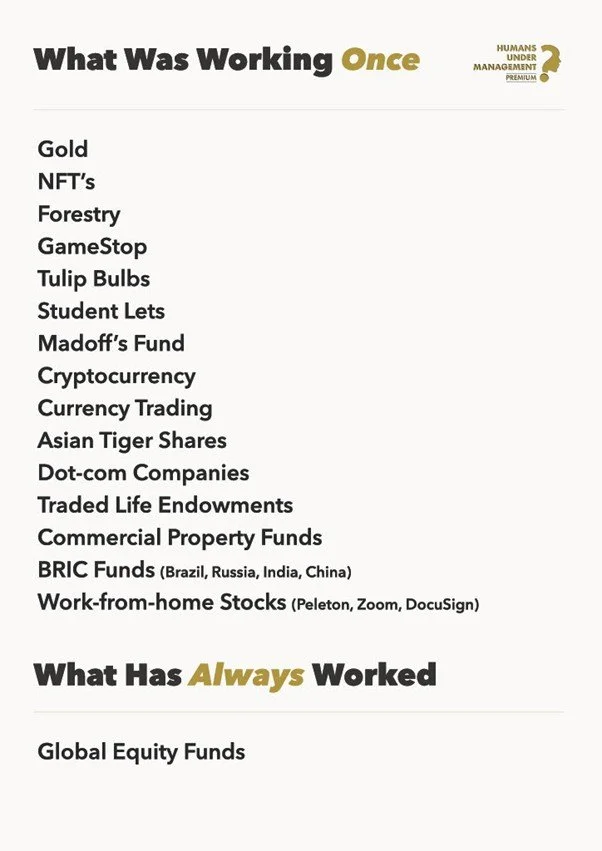

I found this quite interesting. Firstly, I genuinely applaud the Chancellor/Treasury espousing the benefits of investing. We know – history being our guide – that invested funds typically work harder and return more than cash in the bank, and therefore more people that invest sensibly, the better. The caveat there is the word “sensibly”, by which I mean in a well-diversified and low cost manner, as opposed to going all in on one stock (because when that goes wrong, it goes very wrong indeed).

The wording in the official Budget report is “Investing £1,000 a year in an average stocks and shares ISA every year since 1999 would have delivered a £50,000 better return than if it was invested in a cash ISA.”

However, here be dragons.

Firstly, here is another snippet from the aforementioned report stating that “Interest and dividends received on assets held within ISAs will continue to be entirely tax-free”.

If you would kindly please turn your attention to the Tax-free savings newsletter published on 27 Nov 2025, it states:

The third bullet point on the second list appears to directly contradict the earlier report stating that interest will always be received tax-free. Indeed, cash interest within a Stocks & Shares (S&S) ISA can be quite a valuable return at times.

Needless new complexity introduced to our already bloated tax system, yippee! The same encouragement for people to invest could have easily been delivered by simply allowing a small additional allowance on top of the usual S&S ISA limit.

So whilst I applaud the messaging, the mechanism here has the potential to get messy.

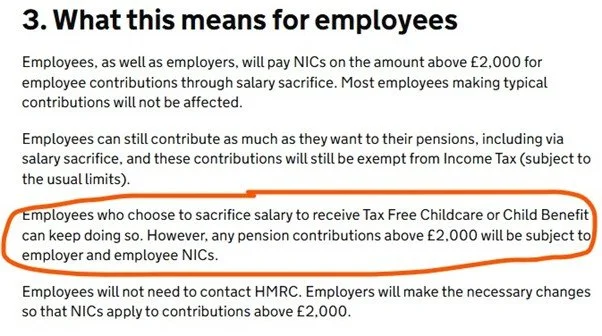

Salary Sacrifice on Pension Contributions Dropped to £2,000

The cynic in me would not be surprised if this policy never saw the light of day, given the complexity in implementation. I note that salary sacrifice would still be able to be used to avoid the Child Benefit High Income Charge, but I am unclear as to how the two will link exactly. More detail required.

It also appears that pure employer pension contributions – a win for the earlier limited company owners – will not be subject to NICs:

Yet, if an employee sacrifices, or has been sacrificing a chuck of their salary – a common strategy for those approaching retirement – they are limited to the £2k. Right. But that is potentially a big tax increase for their employer, given the new 15% NIC rate:

As noted, complexity. So even though this policy has been doing the media rounds as a tax on the saver, it is actually a much greater hit for their employer, given the employer rate of 15% NIC.

Sorry, I am getting into the weeds here and appreciate it perhaps won’t be a common example; people sacrificing more than £2k per annum. But when we consider people putting their bonus into their pension this could be serious extra tax for the treasury.

Oddly enough, for basic rate taxpayers making use of salary sacrifice above £2k, this policy will punish them more than higher-rate taxpayers (the employee NIC amounts being 8% and 2% respectively), so a fair argument could be made that this change is regressive in nature.

We await the Scottish budget now, and one thing I am conscious of is the potential danger of the above. As a reminder, Scots are subject to 42% income tax and the higher rate of NIC (8%) on income from £43,663 to - £50,270. In my opinion, losing 50% of total earnings in this wage bracket is ludicrous (especially when we consider earnings between £50,270 - £75,000 lose 44%), and I am concerned that options here may be limited.

We can but hope.

The Artist Formerly Known as Fiscal Drag

Another quietly painful measure confirmed in the Budget is the continued freeze on income tax thresholds. Personal Allowance (£12,570) and the main higher-rate threshold (£50,270 UK-wide, with Scottish bands separate, as discussed earlier) remain unchanged until at least April 2031.

On the surface, this doesn’t look like a tax rise. In practice, it absolutely is.

With wages, bonuses and even modest pay reviews drifting higher with inflation, more people are being pulled into higher tax bands without receiving a real terms pay increase. This is the textbook definition of fiscal drag – and it is now doing much of the Government’s heavy lifting on revenue.

In simple terms:

You may not feel richer – but HMRC increasingly does.

2025 In Review

As we enter December, with one month still to go in 2025, there is already much for investors to reflect on.

The year began with the inauguration of President Trump, capping a year of elections that saw significant political change across the globe. What followed was a period of uncertainty and theatre around US tariffs that sent markets into a month of turbulence. Elsewhere, peace deals have begun to de-escalate conflicts that dominated headlines for years, while the AI revolution has continued to reshape industries and capture imaginations.

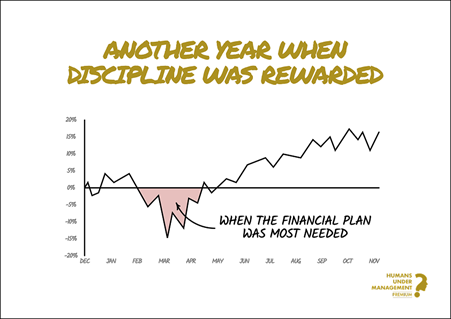

Despite periods of genuine chaos (including a sharp market decline that saw global equities fall by around -19%), it looks likely that 2025 will deliver another year of above-average returns for equity investors. This follows two excellent years of returns in 2023 and 2024.

We know from our conversations with clients that the period from March to April was an uncomfortable period for many. While these periods of decline and uncertainty are always unpleasant at the time, they remind us of the patience and discipline required to become successful long-term investors. The anxiety of early April has been rewarding for those who stayed invested.

While markets are forward-looking and already concerned about what 2026 could bring, there is value in pausing to look back. The events of the past year offer three lessons that can serve us well in the years ahead.

#1 Overvalued Markets Can Still Grow

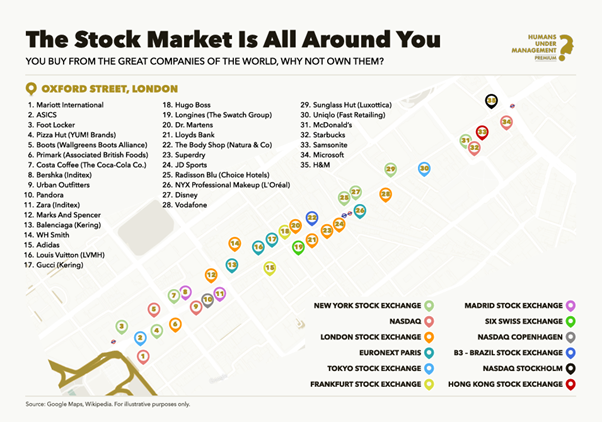

At the start of this year, many commentators warned that global markets looked expensive by historical standards. Yet markets (a collection of the great companies and businesses of the world) have continued to deliver returns, reminding us once again that valuation tells us little about timing.

It can be tempting to wait for a better entry point or to reduce exposure to equity assets when prices seem stretched. But markets can remain expensive for years while still rewarding patient investors. Timing the market requires being right twice: when to get out and when to get back in. History suggests this is a game very few win (if any).

#2 Knowing What Will Happen Doesn't Tell You How Markets Will React

The tariff announcements in early April provided a striking lesson in the limits of information.

On 2 April, the Liberation Day tariffs announcement confirmed what many had expected: sweeping tariffs were on the way. Markets, which had been declining in March, fell sharply as uncertainty took hold. Yet just a few days later, on 8 April, with uncertainty arguably at its peak and no clear resolution in sight, the market quietly found its bottom and began to recover.

Those who knew tariffs were coming had no advantage. The information was widely available. What nobody could know was how and when the market would respond. This is why we focus on planning rather than predicting.

#3 Long-Term Planning Beats Short-Term Prediction

It is rare for the world to undergo a shift as significant as the one we are living through with artificial intelligence. It is genuinely difficult to imagine what daily life will look like in five years, let alone how businesses, industries, and economies will adapt. However, we're confident that the human ingenuity that has seen us adapt and prosper through previous technological revolutions will do so again.

The knock-on effects for financial markets are equally unknowable. And yet, this uncertainty is not new; it is the permanent condition of investing.

Fortunately, the long-term game we are playing is not the short-term game being reported on by financial media. A solid financial plan (an appropriate asset allocation, a margin of safety, and the discipline to stay invested through volatility) remains the foundation for long-term success. Let us resolve to hold onto this truth, especially when the future feels more uncertain than usual.

Thank You

In summary, 2025 has reinforced a timeless principle: we cannot predict, but we can prepare. These lessons, earned through a year of turbulence, will steady you when markets next test your resolve.

As we approach the end of another year, let us continue to focus on what we can control: maintaining robust financial plans and practising patient, disciplined investing.

We wish you a restful Christmas and hope the coming weeks bring time with the people who matter most. Whatever 2026 has in store, we will navigate it together.

We thank you for the opportunity to guide you and your family. It is a privilege to serve you, and we look forward to working with you for many more years.

Wisdom in Picture Form

Because by and large, these images speak for themselves:

Optimism Prism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

CAR-T Therapies Treat Autoimmune Diseases

Boy with rare condition amazes doctors after world-first gene therapy

The First New Subsea Habitat in 40 Years Is About to Launch

Recommendations

I found this graphic interesting – considering the size of the various European economies

Scottish trains and their winter adventures –https://www.facebook.com/ScotRail/posts/pfbid0G1R9HkfozpGzeBSmwmHBSm4WLXsN6mrmzokd9CYSowQmoMQyuhJWb5AF2Nqi9wUul

Some of this firm’s fantastic clients have recently launched a new charitable organisation, named Blue Carbon Trust. The organisation is focused on the restoration of coastal and marine ecosystems, with an example of their work here. I’d encourage you to have a look and, if you would like to know more, their contact details are on the website.

That’s us for this month!

All the best,

Andy

• This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

• Past performance is used as a guide only; it is no guarantee of future performance.

• Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

• The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

• The Financial Conduct Authority (FCA) does not regulate Inheritance Tax Planning or Trust Advice.

• Levels and bases of, and reliefs from, taxation are subject to change and their value will depend upon personal circumstances. Taxation and pension legislation may change in the future.