The End of an Era

Good morning all,

Did you have a fine time over the break? A very Merry Christmas/Happy New Year to you all.

Right, that’s the pleasantries out of the way – what’s the plan for 2026? On this end, more of the same, with any luck. 2025 was a cracker. In the shorter-term, I am in the midst of review season, with meetings galore for the month of January. Nice and busy.

Given that the last Budget is now a mere two months in the distance, I guess we are due the usual rumours about the next one, well, around this time next month? See you all there. I’ll be in the corner dressed as “Pension Tax Free Cash to be Removed”. It’s the same costume as last year.

Well, based on the opening salvo, those of you that expected a more sensible newsletter in 2026 are clearly going to be disappointed.

On the docket for this month – anyone with the “IFA references Warren Buffet” bingo card had better get ready – is a name often mentioned in this blog. The Oracle of Omaha is in his final year as CEO of Berkshire Hathaway. We’ll chat about it.

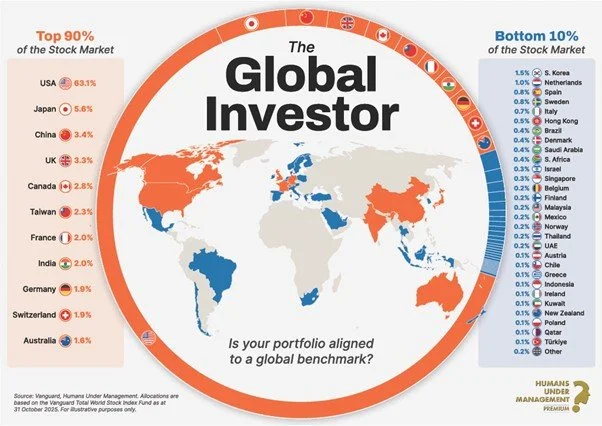

Another topic that has been coming up a lot is concentration risk. It’s a favourite of the active managers. Some sceptical souls might say it is a good marketing ploy, but not yours truly. Active expensive money managers using fear to market themselves? Perish the thought! But on the other hand, the yachts don’t buy themselves, you know?

So we’ll chew the fat on that.

Other than the above, it’s the usual helpful visuals, good news stories, your reminder that it’s never been easier to own the biggest companies in the world, led by the brightest minds in the world.

Monthly Market Visuals

The End of an Era

This year could finally see a team outside of the old-firm lift the…

Whoops, sorry, wrong blog. Using the same headlines does have its drawbacks.

The news that Warren Buffett is finally stepping back from Berkshire Hathaway feels like one of those moments that shouldn’t be a surprise - the man is, after all, in his mid-90s, and has been planning for this for a very long time - and yet, it is remarkable. It couldn’t not be, with that record, and that approach to life generally.

The short version is that what this man has achieved should barely be possible.

It is easy to get lost in the figures, but before we look at them, I suspect his legacy will go far beyond the numerical.

I shall explain. Or try to.

Buffett is the ultimate paradox. He is perhaps the greatest "active" stock-picker in history, yet he spent the better part of the last twenty years telling everyone - including his own heirs - to simply buy a low-cost index fund and to get on with their lives. He’s a man who could afford a private chef for every meal but famously stops at the McDonald's drive-thru for a breakfast sandwich because the market is up and he feels like "splurging" the extra $3 on a McMuffin. Despite the wealth, he lives a very simple – humble? – life.

In a world drowning in media hysteria, AI everywhere you look (I started to write "AI algorithms" but honestly, what even is an algorithm?) and finfluencers screaming about the next crypto “rocket”, Buffett, in his final year, can remind us of the opposite: sometimes the best move with your money is to do absolutely nothing. He calls it "lethargy bordering on sloth."

As he prepares to hand over the keys to the kingdom, the "Buffett Way" remains simple: find something good, pay a fair price, and then have the discipline to stay out of your own way.

That last part is a lot harder than it sounds.

And finally turning to the numbers – as I cannot recall if I have ever noted the actual performance of Buffet before – since he took the reins in 1965 the compounded annualised return of an investor in Berkshire is 19.9%. Over any reasonable time period, those numbers are incredible, but to maintain that since 1965 is frankly absurd.

If you had invested $10,000 in Berkshire Hathaway in 1965, by the end of 2024, you would have had about $550 million. One other very important point: scale. It is "easy" (relatively speaking) to get 30% returns on £1 million. It is extremely difficult on £1 billion. It is considered a miracle on £800 billion.

We shall certainly never see his like again.

Market Concentration: What's Really Going On

If you've been following financial news lately, you've probably seen the headlines warning that the top 10 stocks now make up a larger share of major stock market indices than ever before. Most of these are technology and AI-driven companies, and if these giants stumble, the thinking goes, so will your portfolio.

It's a reasonable concern that we take seriously, but before rushing to make changes, it's worth examining what's actually happening beneath the surface.

These Aren't Really "10 Companies"

These aren't single businesses. They're conglomerates containing dozens of world-class operations that could easily stand alone as publicly listed companies.

Apple's AirPods division alone is thought to generate around $20 billion in annual revenue. If spun off tomorrow, it could be larger than Spotify, Nintendo, eBay, and Airbnb. Similarly, its Mac division, iPad division, and Wearables division would each rank among the world's largest technology companies if listed separately.

The same applies across the top 10. YouTube, buried inside Alphabet, generates $54 billion in revenue and would likely make it one of the 20 largest companies in the world. Amazon's AWS cloud division crossed $100 billion in revenue last year. Microsoft contains Azure, LinkedIn, Xbox, and Office 365, each generating billions independently.

The "top 10 concentration" is partly an illusion of corporate structure. If these companies reorganised into their component parts, the index would look far more diversified overnight, without any change in the underlying businesses you actually own.

Concentration Isn't New

Market leadership has always been concentrated. In the 1980s, it was oil companies and industrials. In 2000, it was the dot-com darlings, many of which no longer exist. The names at the top constantly change, but there's always a top 10 dominating returns.

What's different today is that these leaders have earned their position through actual revenue and profits, not speculation. The earnings generated by these companies justify much of their market weight. They sell real products to billions of real customers every day. This doesn't guarantee future success, but it's a more solid foundation than we've seen in previous concentration cycles.

The Index Self-Corrects

If these companies underperform, they will naturally become a smaller portion of the index. You're not locked in forever to today's winners.

Index investing is designed to automatically reduce your exposure to declining companies and increase exposure to rising ones. The next generation of market leaders, whatever they turn out to be, will gradually replace today's giants as their fortunes change. This process has played out countless times over the past century.

The Practical Question

Even if concentration does lead to higher risk or lower returns ahead, what's the alternative? Trying to predict which companies will decline? Moving to cash? Every alternative carries its own risks and usually involves speculation about an unknowable future.

We understand the concern, but when we look beneath the headlines, we find reasons for continued confidence in a diversified, long-term approach.

If you're investing for a decade or more, today's concentration is unlikely to determine your outcome. Staying diversified across thousands of companies remains the most sensible approach, even if a handful currently dominate the index.

Wisdom in Picture Form

Optimism Prism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Recommendations

Three books this month, for those of you with “more reading” as your resolutions.

Die With Zero – Your kids might not thank me for suggesting this.

And because it’s a new year and I have to recommend this every year (it is genuinely one of my Top 5) Arnold Schwarzenegger’s Be Useful.

That’s us for this month!

All the best,

Andy

The compliance bit:

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

Past performance is used as a guide only; it is no guarantee of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

The Financial Conduct Authority (FCA) does not regulate Trust Advice.

Trusts and will-writing services are not regulated by the Financial Conduct Authority.

Cover will cease on insurance products if premium payments are not maintained.

Generally, pure insurance plans have no cash in value at any time and will cease at the end of the term.