A Tortoise and a Pension Transfer in a race

Good morning all,

Well, it has happened. The AIs have not only become sentient, but have formed their own social media. They are discussing a variety of topics, and I won’t plagiarise the linked article - you can revel in the horror yourself.

What I will say is the way that author Rowland Manthorpe (a Hollywood name if I have ever heard one) refers in the article to the “human owners” of the AI bots. I can see that being read out in a court in 5 years’ time, as the AI feudal master casts his judgement on the weeping and distraught humanoid.

We’re 12 months away from the AI’s clubbing together to buy Sky, rebranding it to Skynet, and, well, you know the rest from there.

I remember being 12/13 and not being able to use the house phone if someone was on the computer, and look at us now. Change continues apace.

Except, perhaps, in the land of pension transfers. It is almost reassuring to know that some elements of life still move at glacial speed with the all the ingenuity of a puddle. More on that later.

In this month’s feast we also have fine news from the good people at Vanguard, a report from yours truly on the fantastic Fundment: Live conference last week, and a look back over the previous three years.

Enjoy!

Monthly Market Visuals

Imagine a Tortoise and a Pension Transfer in a Race

… and you get the idea. No hares required for this tale.

It’s a true, and quick, story that I shall attempt to steer away from a rant. One of the firm’s clients is attempting – that being the operative word – to transfer their old workplace pension scheme away from a legacy provider, XPS in this instance, to a platform where they hold personal assets. All well and good so far, the very definition of “run of the mill”.

Yet, we are now into the 3rd batch of signed paperwork being requested from the ceding scheme, countless risk warnings throughout, and the crème de la crème is their insistence (“or we shall refer the matter to the trustees of the scheme for further consideration, young man”) that the client must sacrifice 20 minutes of their life to go through an appointment/hearing/trial with the scheme’s chosen guardian of the coin (read: a telephone interview with Pension Wise).

A few comments on this, as the process drags into its fourth month.

Firstly, the client has been given tailored advice specific to their objectives and circumstances by a regulated adviser. The ceding scheme knows this, as I have also had to sign my family name away. The pension scheme we are transferring to is not some new operation in a far-flung region, but a £5b+ organisation (also obviously regulated by the FCA, covered by the FSCS, etc).

And finally, and perhaps the most important part, is that it is the client’s money. It does not belong to the scheme, and they do not get to decide (at least for now) what the member decides to do with their money. If the member is of sound mind and wishes to transfer it somewhere else and invest it 100% into ABC Ltd, then that is what should happen, provided the individual is fully aware of the consequences of their decision (as much as one can).

I am all for protecting people where necessary (I’m often parroting scam warnings, both in person and in this blog), but there is a line beyond which we simply become both cumbersome and inept.

Anyway, I’ll wheesht on this point now. Did I keep it away from a rant? Doubtful.

Vanguard: They Keep on Vanguarding

Vanguarding – I’ve invented a verb. I don’t imagine it will catch on.

Whilst not without their flaws, there are few companies I hold in such high esteem as I do Vanguard. The story, the history, their impact on the world, there is a lot to be said for them.

They are the largest, to my knowledge, mutual organisation on the planet. They do not have shareholders, and their profits are re-invested into their funds – often by way of a fee reduction – for the benefit of those individuals and institutions invested in their funds.

They came to the UK in 2009, establishing Vanguard Asset Management Limited, initially offering funds only to institutional investors and financial advisers.

The timing was rather impeccable. The 2008 financial crisis had left many investors deeply sceptical of active fund managers who'd charged handsomely whilst delivering catastrophic losses. The appetite for low-cost, transparent investing had never been greater.

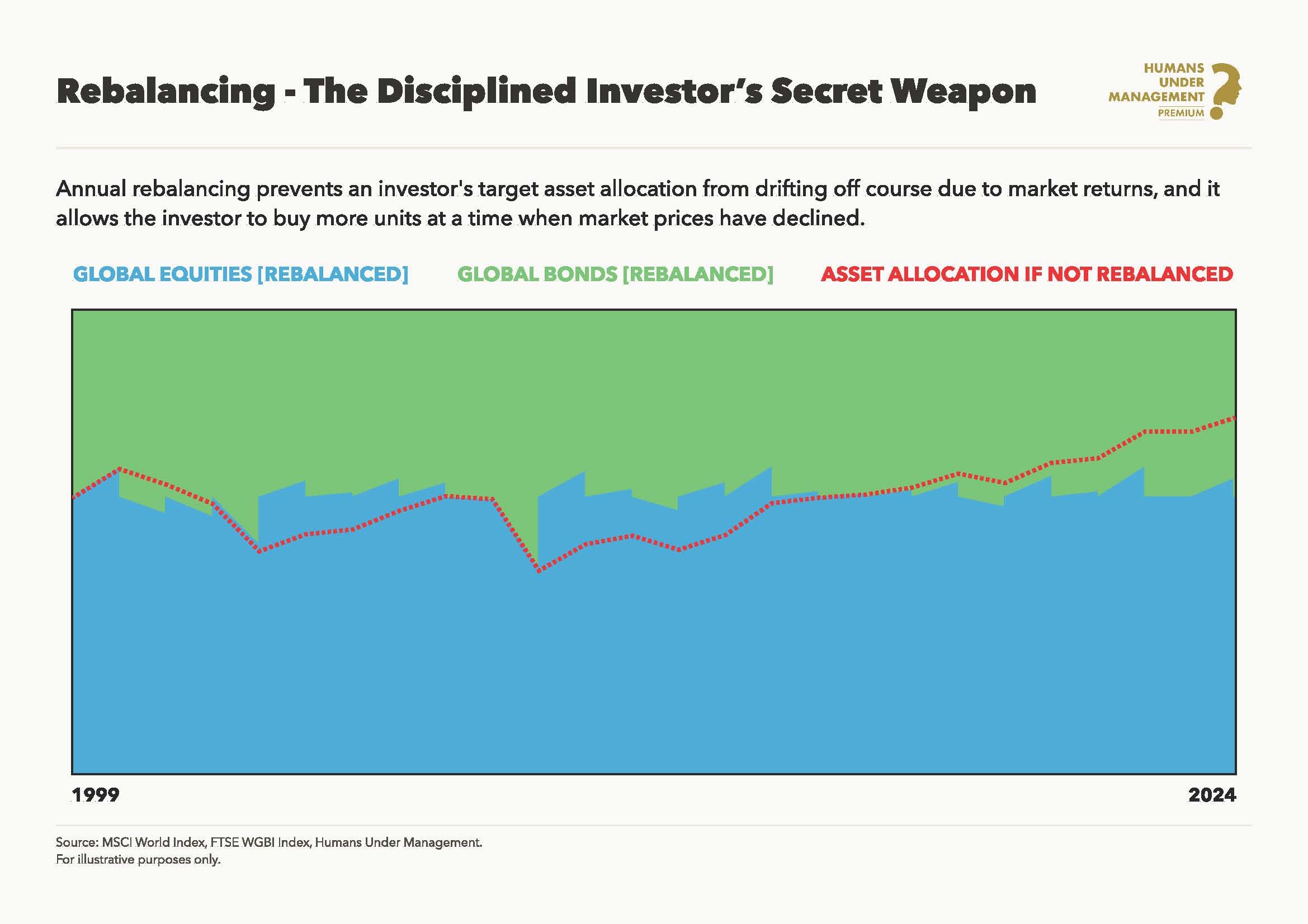

Their main UK offering became their range of funds known as LifeStrategy. Some of the firm’s clients reading this will hold assets in those funds. They are a beautifully simple fund family; five funds of varying allocation to equities, with all rebalancing, asset allocation, and diversification handled within the fund.

No need to construct your own portfolio, no need to rebalance, no stock-picking required. Genuinely beautiful in their simplicity.

As is Vanguard’s habit, the investor fees for these funds have continually been reduced. I am fairly sure, although I cannot find documentary evidence, that the funds started at 0.44% ongoing charges. Due to the popularity of the range and the continual success of Vanguard globally, they have regularly reduced the aforementioned charge figure.

As of last month, we are now at 0.2%. 0.2% for global diversification, exposure to a stock and bond portfolio of your choice, and pretty seamless implementation, is outstanding. And perhaps more impactful is the effect that Vanguard have had on the wider market. Their continual re-investment of profits resulting in fee reductions has forced other large fund managers to consider their position, and they perhaps might not had been so keen to do this, were it not for Jack Bogle’s passion.

I’ve said it before and I’ll say it again; Jack Bogle is one man you will have never heard of, but one who has impacted your life, and millions of others, in a very positive manner.

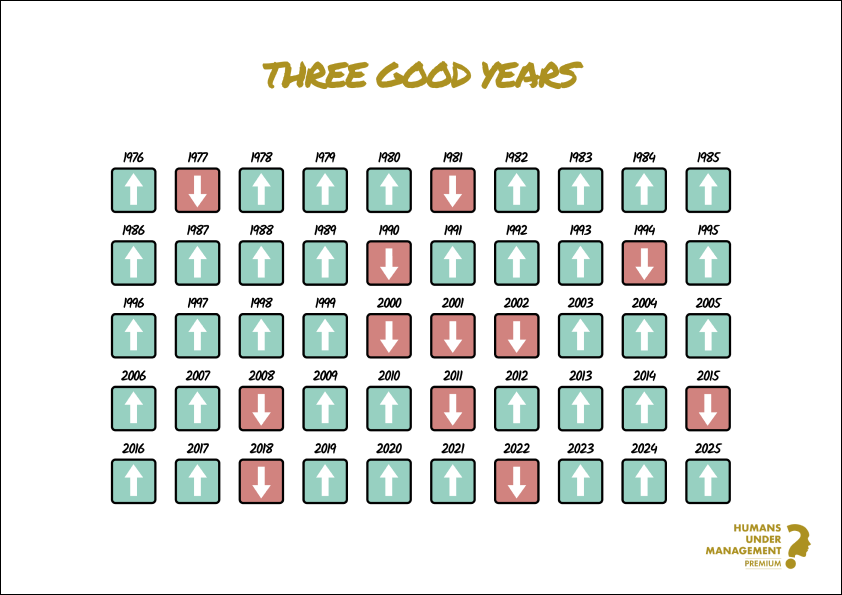

Three Good Years

Global equity investors have enjoyed a remarkable run. The world’s premier stock market index, the S&P 500, rose 24% in 2023, another 23% in 2024, and 16% in 2025. With long-term average returns in the 8-10% range, three consecutive years of above-average performance is something to be grateful for.

This time last year, I discussed with clients the possibility that downside volatility could return after two strong years. It did. Tariff concerns drove a sharp decline in March and April, testing the resolve of investors worldwide. But markets recovered strongly, and those who stayed the course benefited. We enter 2026 with the same mindset.

Understanding the Current Moment

After three above-average years, many investors are asking whether markets have become "overvalued." It's a reasonable question. Unfortunately, it's one that nobody can answer with certainty.

What we do know is that markets tend to revert towards their long-term averages over time. This isn't pessimism. It's simply how markets have always behaved. Extended periods of strong returns are often followed by periods of more modest growth, or temporary declines that bring valuations back in line.

Simply put, a period of below-average returns would be historically normal after the run we've enjoyed. But "normal" doesn't mean "predictable." We have no way of knowing when such a period might begin, how long it might last, or what might trigger it.

What We Can't Know

Current market leadership is concentrated in technology and AI companies. Disappointing earnings from these giants could certainly trigger a change in sentiment. But the decline we experienced in early 2025 came from tariff concerns, something few were discussing a year earlier.

The trigger for the next market decline is almost always something different from what investors expect. This is precisely why we prepare rather than predict. Decades of evidence show that trying to time market exits and entries has consistently failed investors.

How to Approach the Year Ahead

Given all this, you might be tempted to make portfolio changes now. To shift to a more "defensive" position in anticipation of a potential decline.

Generally: resist this urge.

Your portfolio is already designed around your long-term goals and your ability to weather temporary declines. Making changes based on feelings about where markets might head in the short term isn't planning, it's speculation.

Instead, ensure you have sufficient cash available for any known short-term expenses. This simple step prevents you from being forced to sell investments at an inopportune time. Beyond that, your long-term investments should remain exactly that: long-term investments.

The irony of good preparation is that it often looks like doing nothing. The financially literate understand this and find peace in it.

Standing Ready with Confidence

Whether 2026 brings continued gains or a temporary setback, your long-term trajectory remains unchanged. Declines, when they come, have always been temporary. The long-term growth of the great companies of the world has been permanent.

Your role is not to predict the future but to remain invested through it. We've navigated uncertain periods before. The experience of 2025 reminded us that this approach works.

I remain confident in the wealth-building power of owning shares in the world's leading businesses. These companies will continue to innovate, adapt, and grow their earnings regardless of what headlines dominate the news cycle.

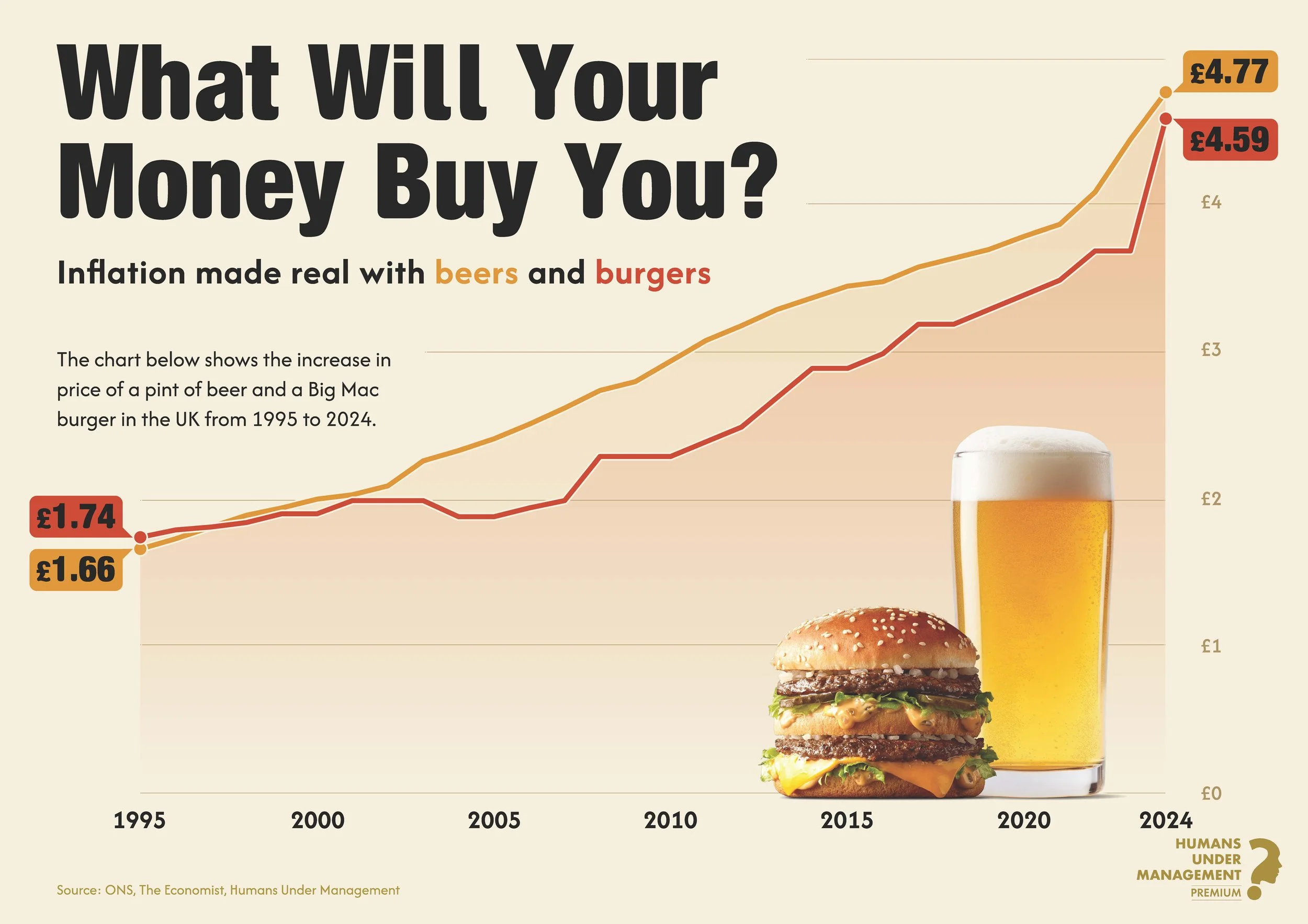

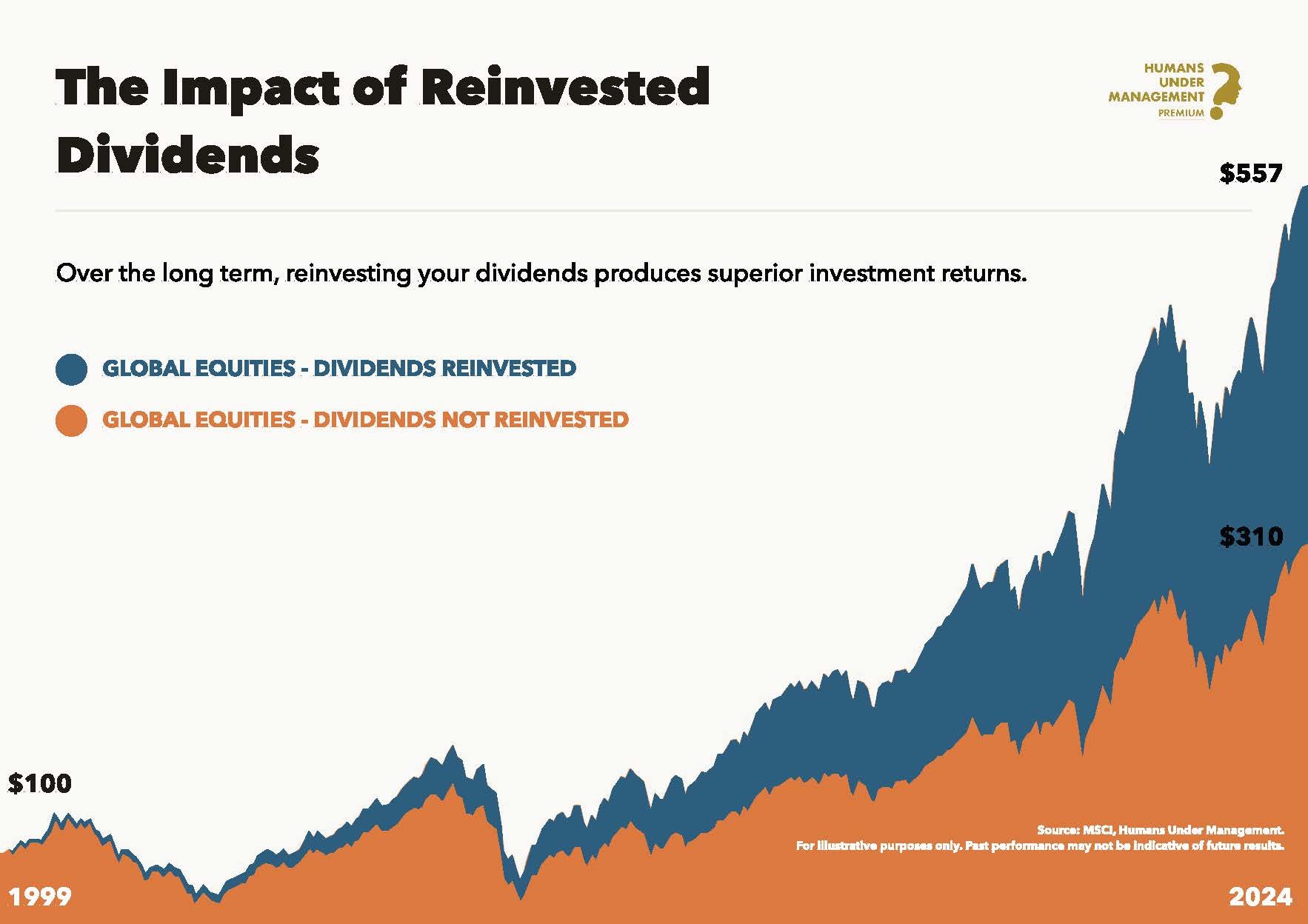

Wisdom in Picture Form

Because by and large, these images speak for themselves:

Optimism Prism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Recommendations

The book I read last month I cannot recommend. So take this as an anti-recommendation if you will. I read 1984 by George Orwell, which I’d heard good things about. I spent the bulk of the book waiting for the revolution, and it didn’t spark anything in me.

Claude Code. Wow. I know not the slightest thing about code, but even I managed to build a functioning website/app within an hour. Vibe-coding, the cool kids call it.

And a podcast to finish us off. Noiser is probably my favourite podcast production team, and they’ve got another great out there with Real Dictators. It doesn’t beat their ‘Short History Of’ podcast, but it’s still a great listen.

That’s us for this month!

All the best,

Andy

The compliance bit

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

Past performance is used as a guide only; it is no guarantee of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested.

The Financial Conduct Authority (FCA) does not regulate Trust Advice.

Trusts and will-writing services are not regulated by the Financial Conduct Authority.

Cover will cease on insurance products if premium payments are not maintained.

Generally, pure insurance plans have no cash in value at any time and will cease at the end of the term.