Interest Rates, a Cookbook, and some good news to end on: November 2023 Newsletter

Interest rates - Stick or Twist?

How on Earth are we in November already? This year has absolutely flown by. If you’re particularly organised like my wife, you’ve already got Christmas - yes I said it. It’s after Halloween so I think I’m in the clear -sewn up.

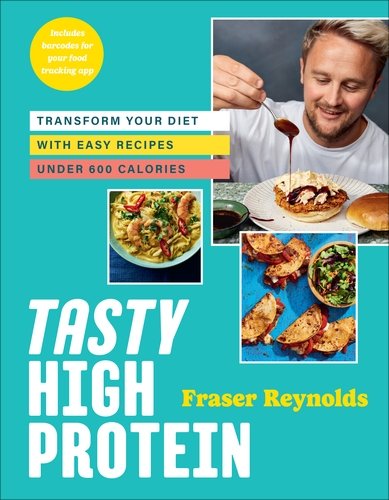

Speaking of Christmas, a slight diversion from the norm, and a shameless plug. My brother Fraser Reynolds has his debut cookbook out on the 28th December. That’s not a sentence I thought I’d ever write. Life, eh?

Back to business.

The Monetary Policy Committe have recently announced their latest decision on interest rates. As you will likely know, they were held at 5.25% after 14 consecutive increases. Despite the UK’s rate of inflation remaining stubbornly high at 6.7%, rates have been held again. So, we crack on at 5.25%.

Rising interest rates can be good news for savers, so make sure you’re not still on one of the old, frankly dismal, interest rates of sub 1%. If you do have cash in the bank, there are few better references than Martin Lewis’ website for a list of the top rates available.

Interest rate changes can have a significant impact across your financial planning, whether in respect of a mortgage, short-term savings, or your longer-term investments. As always, please don’t hesitate to contact us with any questions.

Earn less to be paid more

Specifically, in this context, I mean “earning less” in the form of salary sacrifice for pension contributions.

In the UK, we have various options when it comes to funding their retirement, and one popular method is through salary sacrifice, although it often depends on whether your employer offers this option.

Salary sacrifice allows employees to make additional contributions to their pension funds by redirecting a portion of their salary before it suffers income tax and, crucially, national insurance. This arrangement offers several advantages, including tax benefits and potentially increased savings for retirement. It can also - provided it is introduced correctly - save an employer thousands of pounds per annum. That said, there are some really important factors to be aware of, such as making a contractual change to an employee’s terms of employment.

How Does Salary Sacrifice Work?

Salary sacrifice is an agreement between an employer and an employee. Instead of receiving a portion of their salary as direct income, the employee agrees to have the equivalent amount paid into their pension fund directly by their employer. By doing so, employees effectively reduce their taxable income, leading to potential tax and NI savings.

We’ve put together a short video to introduce it properly - although please do pay attention to the risk warnings underneath the video and copied below:

It is important to note that salary sacrifice is not suitable for all employees.

Employees’ pre-tax salary will be reduced. This may affect their entitlement to State Benefits.

Mortgage lenders may calculate borrowing amounts in terms of the reduced salary.

Life cover or income protection policies may pay out on a multiple of salary. This may be less if salary is sacrificed.

Employees earning more than £260,000 with a tapered annual allowance may incur additional annual allowance tax charges.

Salary sacrifice cannot be used if it would reduce an employee’s earnings below the National Minimum Wage / National Living Wage.

Note that salary sacrifice arrangements should be appropriately documented with the employee signing an agreement letter unless it is written into the employment contract. In addition, you would need to ensure that your employee payslips can display the amount of the salary exchanged.

Where do returns come from?

When agreeing on an investment portfolio, one of the most important decisions that an adviser and client will make together is the allocation to “growth assets” versus “defensive assets”. Typically, growth assets are the main driver of positive investment returns and are generally equities - company shares in other words.

But where do equities, the shares themselves, get their growth from? What causes the increase in capital value of the share?

Well, there are two principal drivers for this growth. It’s important at this point to note that growth in share value is never guaranteed and subject to the underlying performance of the company in question.

The first driver is company earnings. In short, how much money the company generates from selling its good or services, and how much of these earnings it retains versus the cost of doing business, and tax.

The second is shareholder dividends. The amount of money the company pays out from these aforementioned profits to its shareholders. How likely this is to continue, and what the prospects are for future payments.

Both of these are crucial factors that influence the potential increase in the value of a company share.

And, perhaps more importantly of all, how have these drivers held up over time? How have they compared to inflation, that silent destructor of wealth?

We think it is best explained visually.

As always, please note that with any investment there will be volatility, there is no guarantee of positive performance, and past performance is not a guide to future performance.

At some point your investment may be worth less than the amount you originally invested.

Some good news to end with

As I’m sure we’re all aware, there is a lot of negative news around at the moment. So much so, it is easy to miss some of the more positive stories out there, the signs of human progress. Thankfully, there are some:

And there you have it team, that’s November’s edition wrapped up. If you’d like to join the list and hear from the firm regularly, simply jot your email in the section below.