An Unknown Hero to Millions

Parts of this newsletter are going to be a bit of a love-in. I make no apology for that, but I will try to avoid going full fan-boy. The man in question, in a business sense certainly, is a titan and someone we all owe a great deal of gratitude to.

The funny thing is, you’ve likely never heard of him. We’ll get to that in a little while.

I have learned that this newsletter/blog works better if I do it first thing in the morning, when the caffeine is coursing through the veins and my soul hasn't yet been plunged to the depths of fiery purgatory that is a natural consequence of listening to a certain unnamed (oh, but I am tempted) pension provider’s hold music.

On another note, spring has sprung! Optimism is in the air; the days are getting longer, and the feel-good factor is back. The markets are doing what they do, with many of them showing healthy gains already this year, and that of course after a stellar year last year. That said, please don’t be worried when the inevitable fall(s) occur. It will happen, and it is a normal part of investing - nothing to be worried about.

To balance out the good news, we do of course have the introduction of the new Scottish rates of income tax coming into play on the 6th of April. The main one to watch out for is the new Advanced tax rate, which is a considerable 45% on earnings from £75,001 to £125,140, a 3% increase from the current 42%. Don’t forget to add in your 2% national insurance (income tax by another name), resulting in a total 47% loss of earnings on income in this bracket. Not ideal.

There are some actions that we can take to plan for the above, pension contributions being the obvious one. Directors of limited companies should note that dividends are taxed under the more generous UK regime, and that could be an option. If you’d like to chat through your options, the proverbial door is open.

The Hero We Never Knew We Had

“Jack did more for American investors as a whole than any individual I’ve known. A lot of Wall Street is devoted to charging a lot for nothing. He charged nothing to accomplish a huge amount.”

– Warren Buffet on the one and only Jack Bogle. Let the love-in commence.

Jack Bogle, ladies, and gentlemen. Or, to give him his full moniker, John Clifton “Jack” Bogle.

The condensed version is that Bogle was the founder of what became the Vanguard Group, but as you might expect, there is a lot more to the story. Harping back to last month’s blog where we discussed the benefits of ‘passive’ – a better word is ‘efficient’ – investing, I didn’t explain the origins of this form of investing.

Let’s go back to 1976, two years after the formation of the Vanguard Group. At this point, there was no such thing as efficient investing. There was only the active option, with the additional complexity and costs that this entailed.

Enter Jack Bogle. In 1976 he was ready to launch the world’s first index fund. As we covered last month, this is a fund that simply ‘buys and holds’ all the constituents of a particular market at ultra-low cost. Seeking funding for this new venture, Bogle spoke with other investment companies and wealthy individuals, explaining the concept and the philosophy. He was ridiculed, laughed out of offices, and in some quarters fiercely attacked for being “anti-American”, such was the perception of a fund that “would only return the average”.

The concept, and the index fund that Bogle launched, was colloquially called “Bogle’s folly”.

But Bogle persisted, against tremendous kickback and mistaken sentiment. You can predict the rest, the fund and the organisation swelled as investors realised he was on to something, and the Vanguard Group became a behemoth.

Today, Vanguard is the second largest asset management group on the planet, behind only Blackrock. My personal belief is that they will eclipse Blackrock, but that’s for another day.

So, what was so good about all of that? Yes, that’s a nice “against the odds” story, but how has it benefitted the average investor in the western world? Scratch that, benefitted the average person. Because if you have a pension (which is pretty much every employee in the UK), regardless of size, you’re an investor.

Well, because Bogle’s philosophy was ultra low-cost investment options at mass availability, this quickly led to the rest of the industry having to adapt their pricing and practices to compete.

Vanguard was coming in so competitively priced, and their products were so simple, that the rest of the investment world had to make sweeping cuts to their fee structure - albeit over an extended period – to compete. The “Vanguard effect” continues to this day.

In simple terms, this meant that as people were paying less in fees, their pensions and investments were keeping more of the returns generated.

It would be virtually impossible to estimate how much money has moved from the coffers of wealthy investment banks to the pensions and savings of ordinary people because of the determination of one man to turn an industry on its head.

Shareholders? What shareholders?

But that’s not the end. Not only did Bogle revolutionise investing in terms of fees and operations, the way that he set up the Vanguard Group was also remarkable. The Vanguard Group is the largest mutual organisation in the world. There are no shareholders. None.

The Group is owned entirely by its own funds, which are freely available to invest in regardless of wealth or status. People like you and I, the investors in such funds – and many millions beside us – therefore own a proportion of Vanguard. The structure is so very rare and, because there are no external shareholders demanding dividends, profit increases, etc., much of the profit the Group makes is reinvested into its funds, which results in a continual lowering of fees.

Crazy, isn’t it?

Just imagine what that company, the second largest asset manager in the world (managing $7.7 trillion in April 2023, revenue of roughly $7 billion per annum), would be worth had Bogle kept even 10% of the equity for himself and his family. I can’t imagine where his wealth would be. But that was never the intention for him, and countless millions, probably billions, have benefitted in his stead.

A legend in every sense of the word.

Cash is King

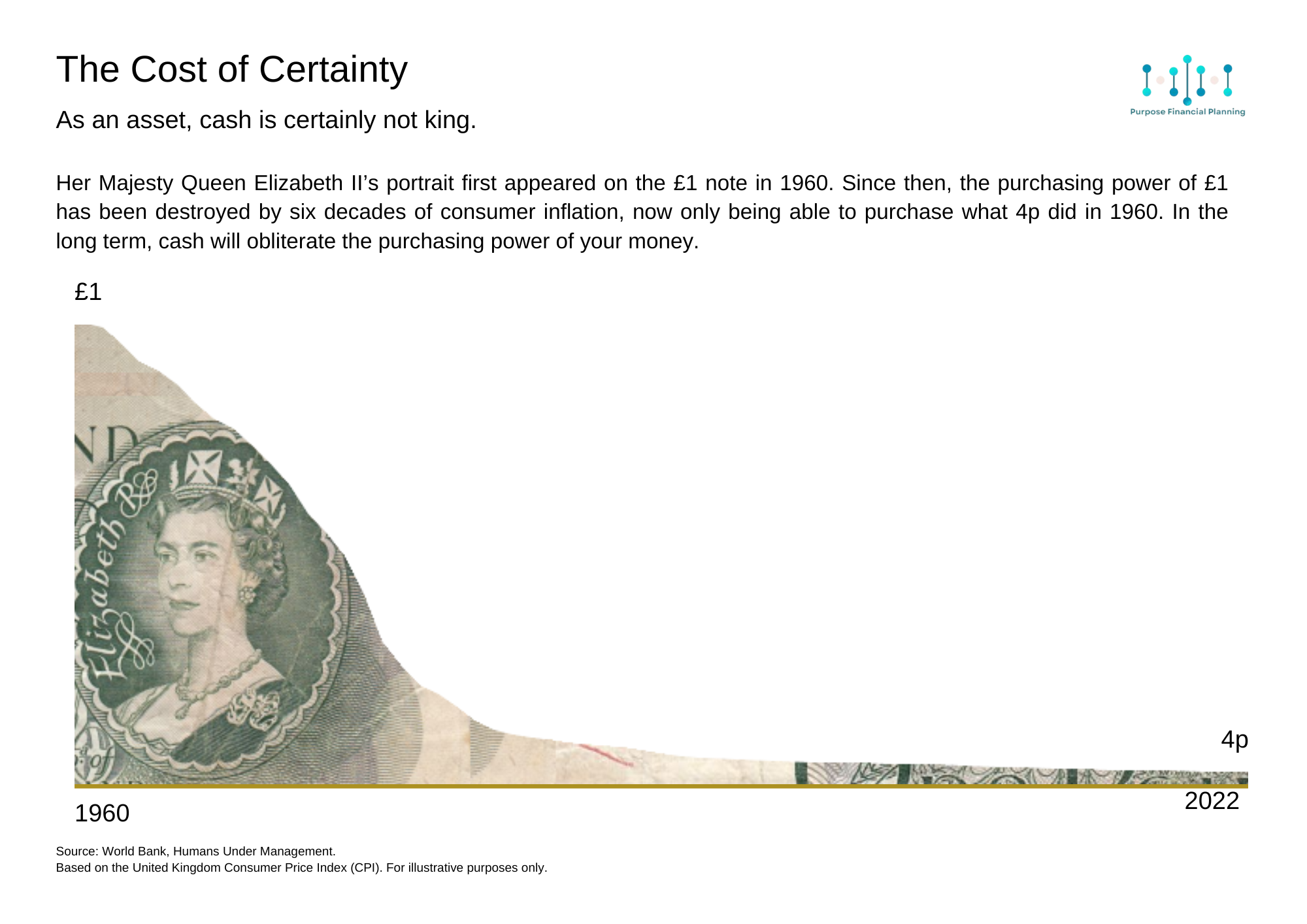

This is a phrase we hear a lot in the UK. We’re often taught as we’re growing up the importance of cash, the necessity of saving. And that’s good, I’m all for that. What I’m less a fan of is the concept of cash being viewed as “safe”, the idea that the value of cash does not decrease. It most certainly does.

Inflation is the silent killer of the value of cash. We don’t see it, we don’t hear it, we don’t feel it. Indeed, it can be many years before we notice it. But notice it we will. Of course, by the point we do, it’s often too late to do anything about it:

So unfortunately, the only thing that we can be certain of regarding excess cash in the long-term is guaranteed destruction of our wealth and purchasing power. That may seem harsh, but it’s the truth.

Don’t let your hard-earned money fall victim to inflation.

The Optimism Prism

Your monthly dose of the good stuff:

The fantastic charity RedStart, an organisation working in primary schools aiming to develop children’s understanding of personal finance. Looking forward to getting involved.

Liverpool is Building the World’s Largest Tidal Power Project to Power a Million Homes

All hands to the pumps: the colourful rise of community-owned pubs

Recommendations

Somewhat cheeky I’ll admit, and not a true recommendation, but the firm’s digital brochure is now up and running. Feedback – and criticism - gratefully received, and if you felt comfortable sharing it with someone you know, that would also be very much appreciated. Thank you.

A new book recommendation this month, Shoe Dog by Phil Knight. This is the creator of Nike’s memoirs on the trials and tribulations of building that now household name. Very digestible, and a cracking listen - a band of misfits succeeding against the odds.

A newsletter that puts all others in the shade. Yes it’s principally focused on a US audience, but the Morning Brew newsletter is a quick, well-written blast of the previous day’s news. I think you’ll like it.

All the best for now, and we will catch up next time. Thoughts, comments, and feedback are always gratefully received.

Andy

The compliance bit:

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

The value of investments may go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief depends on individual circumstances.

A pension is a long-term investment, and the value is not guaranteed. Any advice or considerations are again personal to each individual’s circumstances.