One Must Never Mention The Stock Market Again

Well, what on Earth happened there then? In the preceding entry to this, in this no doubt-soon-to-be-award-winning financial blog, I talked about how things were going quite well in the stock market. I told a story explaining that, naturally, things would go belly-up at some point and the media would basically impersonate a toddler who’s ice cream was served one half degree too warm/cold. Perish the thought.

Then, a mere TWO WORKING DAYS LATER, we have an interesting set of events. The Japanese market starts the fun, with it’s biggest decline since 1987; 12% in a day, nonetheless. The US then had a good wobble at a near 3% loss in a day, and the European markets followed, with red across the board on Monday 5th August.

The media took it really well:

- “$6.4 Trillion Stock Wipeout Has Traders Fearing ‘Great Unwind’ Is Just Starting”

- “What caused the global stock market meltdown”

- “Reason to Panic? The Global Stock Market Plunge”

- “Wah-Panic-Sell-Everything!!!!”

Okay, I made that last one up, but you get the gist. Clickbait galore (which is, of course, the point of such headlines). The internet media, awash with the advertising inserts down the side of the webpage, exists not to inform you but to attract your attention. Thus increasing their own marketing revenues. That is their sole purpose, in this context anyway.

If you’re not paying for the product, then you are the product.

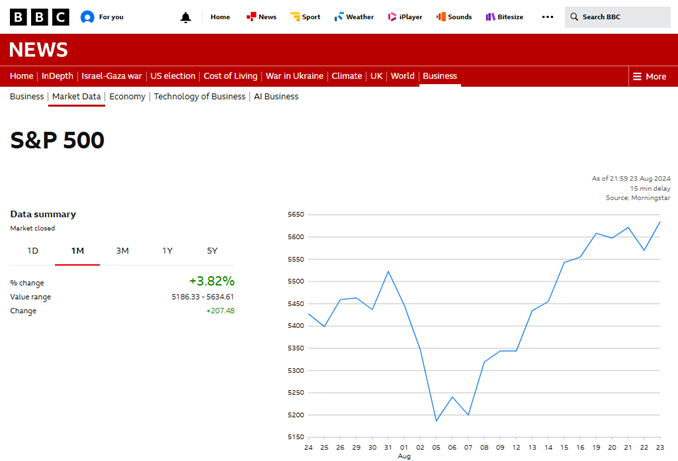

Conversely, have the headlines been awash with the fact that since the 5th August and all those “billions were wiped off the market” that we are, across most markets, pretty much back to where we were at the start of the month!? Indeed, at the time of writing (24th August) the S&P 500 is actually 3.82% up on the preceding month:

Of course we have not.

Much more importantly, and this is the part to remember, is that the declines we witnessed worldwide on the 5th August, were completely and utterly normal. Nothing at all out of the usual. Borderline expected, you could say.

The average intra-year decline in the S&P 500 over the past four decades is 14%. 14% - a lot higher than most people think.

Yet, and here’s the kicker, even with an average intra-year decline of 14% in each of the last 44 years, 33 of those 44 years have ended positively. Even some years with larger than average declines finished with punchy growth:

Remarkable numbers, really. As I’m sure I’ve said before, the temporary, sometimes sharp declines are the price of the inflation-busting returns that investors enjoy. The temporary drops, whilst painful at the time, are a necessary feature of the wonderful magic of compound growth via the stock market.

The moral of the story is, of course, that I should avoid ever again making reference to the markets. Such behaviour clearly does not please the vengeful gods of capitalism.

That said, it will definitely go down again though. And also up. No, I don’t know when.

Dividends and Buybacks

A brief foray into the mechanics of an increasing share price here. You might find it interesting, as it’s a far-less covered aspect of how stock market wealth can increase through time.

Most of us are fairly comfortable with the idea of a dividend. When a company is doing well, it will often pay out dividends to shareholders, who are the ultimate owners of the entity. Nice and simple. A reward for the shareholders investing their capital in that organisation.

But less well known is the concept of a share buyback. This is a popular activity in the US, and given that the US is over 60% of the world’s stock market, it is important to us all.

A buyback is when a company buys back shares from investors and simply cancels them. They vanish into thin air. The immediate impact of this is to increase the ownership percentage of any remaining shareholders and (often but not always), as an indirect consequence, boost the value of the remaining shares. Each remaining share now owns a greater proportion of the company, as there are fewer shares in existence. Supply and demand, and all that.

Share buybacks are often viewed as “one-off” events. They can occur without warning or expectation of annual repetition.

By contrast, dividends are much more consistent and almost expected by the market. Companies are often punished with a sharp share price decline in the event of a dividend cut, whereas share buybacks suffer none of this.

The chart below shows US CEOs’ preference for buybacks over dividends, particularly since the mid-2000s. The stable blue line represents dividends, while the fluctuating pink line represents buybacks, highlighting their flexibility.

Source: S&P Dow Jones

Buybacks also tend to be tax-efficient, as they’re only taxed once (on the shareholder under capital gains rules), whereas the money for dividends is taxed twice (corporation tax and then shareholder dividend tax).

Apple this year is planning to spend $110 billion on share buybacks.

There you have it. Gripping stuff.

“If your kids can’t sleep, simply tell them about share buybacks. They’ll be out like a light in seconds.”

The above is feedback from my wife. Her praise knows no bounds.

Update on the business

It’s been a little while since I provided the numbers on this. Having reviewed the back catalogue, the last update I can find was December last year, at which point the firm looked after 17 client families, having started with 10 client families in July 2023.

We now very proudly serve 34 client families, with some others hopefully joining over the coming months.

I was fairly terrified before going out on my own, what with a young family and a dog with an insatiable appetite, but its genuinely been a joy from start to finish, and that’s down to the superb people that I am lucky enough to work with.

So thank you all, immensely. It is never, ever, taken for granted.

I did a thing (kind of)

Like a dog up a tree, I have no idea what I am doing here, nominated in the Entrepreneur of the Year category at this year’s Verve Awards. I’m amongst people I have no right to call peers, but delighted to be there all the same. There are some superb firms in every category, and I’m sure it’ll be a smashing occasion. Thank you again to The Verve Group.

Optimism Prism

Your monthly dose of the good stuff:

• Runner raced against great-grandson on 85th birthday

• Manuka Honey Reduces Breast Cancer Cell Growth by 84% in Human Cells and Mice

• The World’s Largest 3D Printer Is Building Cozy Homes from Wood

Recommendations

· Okay, they’re a bit “out there”, but the submitted accounts of Net World Sport Limited [PJ1] [AR2] are unbelievable. A few good chuckles in there. Read Group Strategic Report onwards.

· I am a Dan Neidle (tax lawyer turned, well, let’s say “tax detective”. That sounds catchy) fan. I’ve mentioned him before, so why break habit. He is well worth a listen on “The Rest is Money”, episode 80, here. Whilst on that subject, the latest Tax Policy Associates report into an R&D tax-relief scam is a fascinating read.

The compliance bit:

This newsletter is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief depends on individual circumstances